Leading dialysis service provider NephroPlus to invest INR 200 cr for new centres

The 40 international centres will be in countries in South East Asia, Middle East and Africa, he added.

- Country:

- India

Leading dialysis service provider NephroPlus is looking to invest around Rs 200 crore to open up to 120 new centres across India and 40 centres oversee by the end of 2020 as part of its expansion plans, a top company official said.

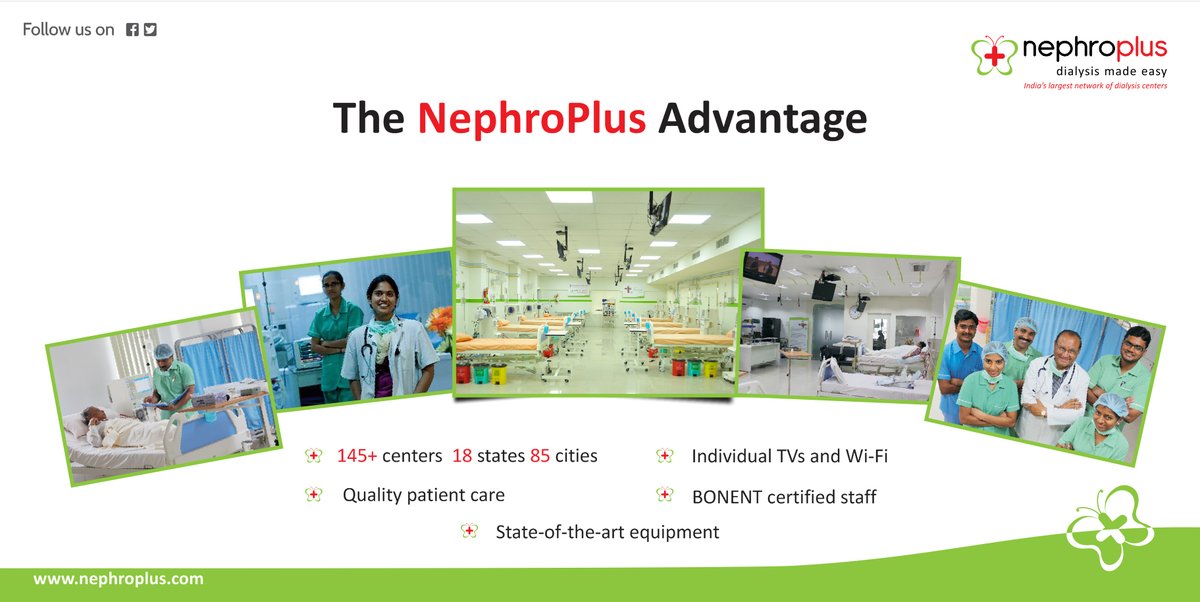

The company currently operates 141 centres in 86 cities across 18 states in India.

"We will be setting up to 120 new centres in India and around 40 centres internationally by the end of 2020. We will have close to 300 centres overall by that time," NephroPlus Founder and CEO Vikram Vuppala told PTI.

The 40 international centres will be in countries in South East Asia, Middle East and Africa, he added.

Vuppala said, "NephroPlus would be investing around Rs 1 crore per centre in India, while it would be between Rs 2 crore to Rs 2.5 crore for the international centres."

On being asked how the company plans to fund the expansion, he said, "It will be mainly through internal accruals. We are also in initial conversations for next round of funding which will help us for international expansion."

The company is profitable at a network level, he added.

When asked about the locations of the new centres, Vuppala said the focus would be mainly on tier II and tier III cities in the country as these places still lack the proper dialysis facilities.

The dialysis provider has already completed three rounds of funding till date.

NephroPlus had raised Rs 100 crore in a series C round of funding, led by SeaLink Capital Partners (SCP) and International Finance Corporation (IFC) in August 2016.

It had earlier received USD 10 million in a series B round of funding from IFC and existing investor Bessemer Venture Partners in 2014, and USD 4.25 million in a series A round led by Bessemer Venture Partners in 2011.

(This story has not been edited by Devdiscourse staff and is auto-generated from a syndicated feed.)

ALSO READ

Senior US treasury officials to urge India to maintain implementation of Russian oil price cap

Indian Navy hands over nine pirates to Mumbai Police

Pakistan Volleyball Federation invites India for tournament in Islamabad

Senior US treasury officials to urge India to maintain implementation of Russian oil price cap

"Because of Hockey India's support, I am able to help my family": Salima Tete after winning Player of the Year award