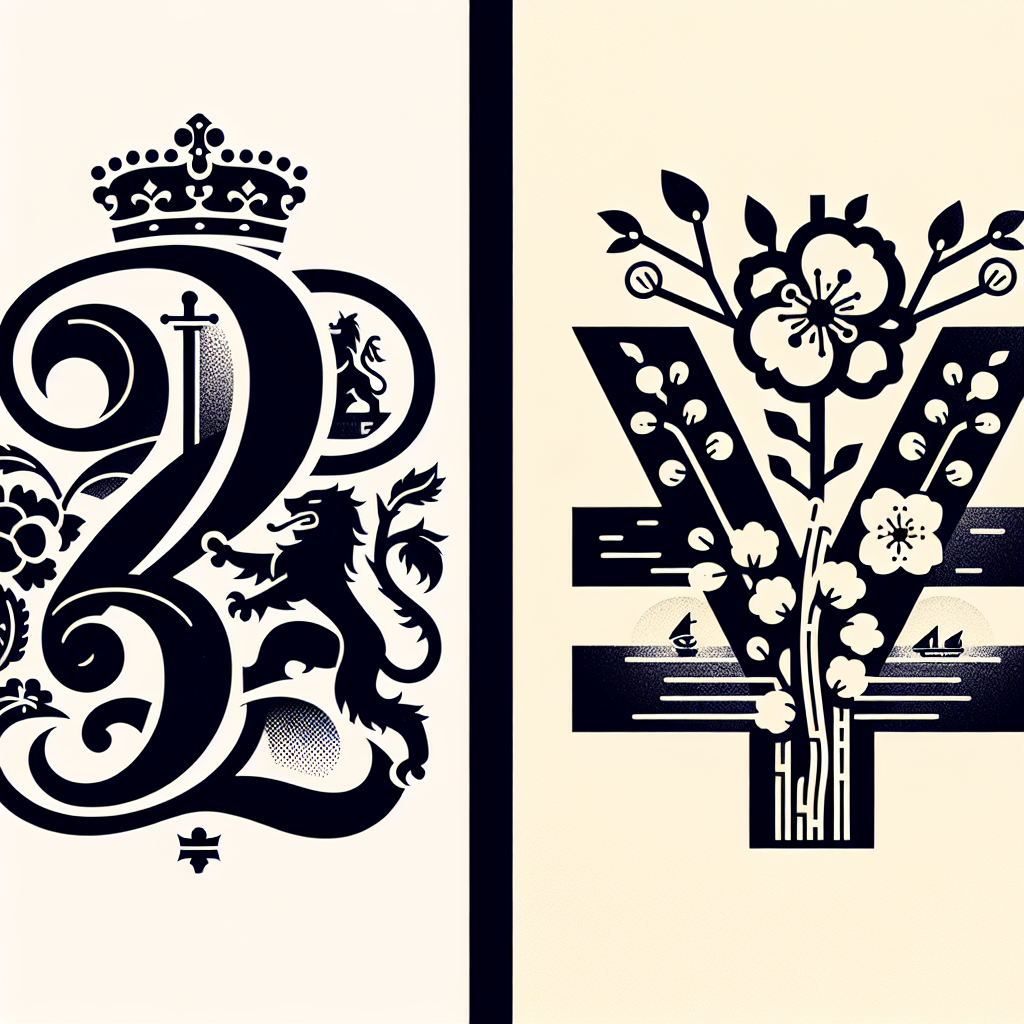

Yen's Surge: Bank of Japan Hints at December Rate Hike

The Yen experienced its largest rally in nearly two months after the Bank of Japan suggested a possible interest rate hike in December. Investors are betting on U.S. rate cuts, weakening the dollar. Market reactions point to a pivotal month for global currencies and central bank policies.

The Japanese yen rallied significantly on Monday, marking its biggest one-day surge in almost two months. This was in response to Bank of Japan Governor Kazuo Ueda's suggestion that an interest rate hike might occur in December.

Simultaneously, the U.S. dollar struggled amid investor speculation of a rate cut, while the BOJ considered the implications of their potential rate increase. The yen's rise affected the euro and pound negatively.

Market analysts view December as a crucial month for global currencies, with the yen expected to stabilize if the BOJ follows through with its fiscal strategies. Traders continue to navigate uncertainties in central bank policies worldwide.

(With inputs from agencies.)

- READ MORE ON:

- Yen

- Japan

- Bank of Japan

- rate hike

- dollar

- currency market

- Ueda

- forex

- central bank policy

- December

ALSO READ

MORNING BID EUROPE-Firming Fed cut bets buoy stocks, undercut dollar

GLOBAL MARKETS-Global shares and dollar higher as markets eye Fed rate cuts

GLOBAL MARKETS-Global shares and dollar higher as markets eye Fed rate cuts

GLOBAL MARKETS-Stocks higher, dollar to extend losing streak, as markets weigh rate cuts

GLOBAL MARKETS-Stocks higher, dollar to extend losing streak, as markets weigh rate cuts