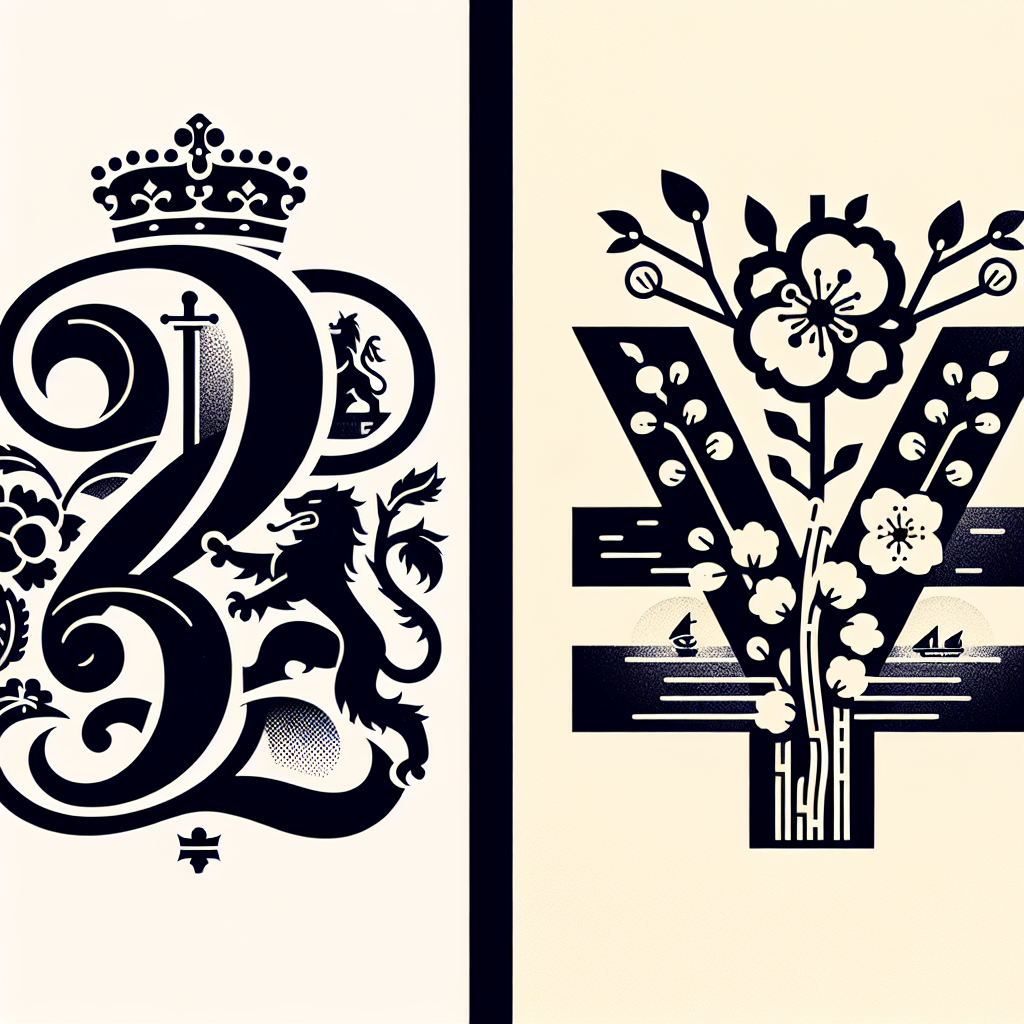

Yen Tumbles Despite BOJ Rate Hike: Market Awaits Intervention

The yen fell significantly against major currencies after the Bank of Japan (BOJ) raised interest rates but provided little guidance on future hikes. Market speculation of potential BOJ intervention increased as the yen approached critical levels. The situation remains volatile amidst global currency fluctuations.

The yen experienced a substantial decline against major global currencies following the Bank of Japan's decision to raise interest rates. Despite the increase, BOJ officials offered scant insights into upcoming rate hikes, prompting traders to speculate on potential official interventions as the yen nears critical thresholds.

The persistent slide of the Japanese currency highlights underlying economic challenges. BOJ Governor Kazuo Ueda's vague statements at a press conference failed to reassure markets, leading to a continued depreciation of the yen, now at its weakest level against the dollar in a month.

In light of the festive season and expected thin trading, volatility is anticipated to increase. With intervention risks looming, analysts express concerns over currency stability, considering recent shifts in foreign exchange rates and interest rate expectations.

(With inputs from agencies.)

ALSO READ

Global Financial Trends: BOJ Rate Hike, Yen Volatility & EU's Ukraine Support

Dollar Declines Amid Lower Inflation and Bank of England's Rate Cut

Currency Markets React to Global Rate Decisions: A Tumultuous Week for the Dollar and Sterling

Navigating Crypto with Dollar Cost Averaging: A Safe Haven in Volatile Markets

Digital Dollars: Africa's Answer to Inflation Woes