Need to boost agri-finance to Rs 10 lakh cr through cooperatives: Shah

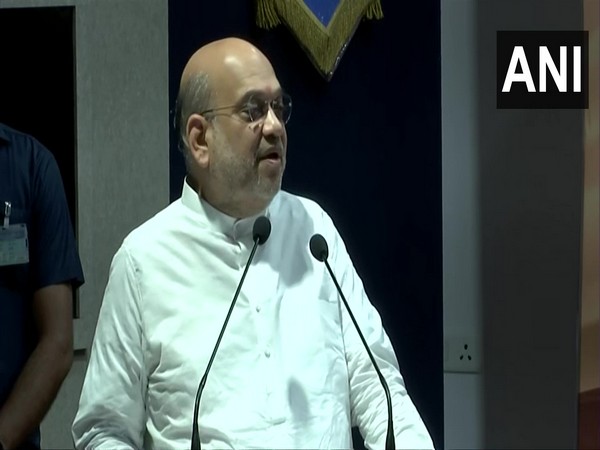

Cooperation Minister Amit Shah on Friday made a case for expanding the network of primary agriculture credit societies to every panchayat with an aim to increase agri-finance to Rs 10 lakh crore annually through cooperatives.While addressing a national conference on rural cooperative banks organised by Ministry of Cooperation and the National Federation of State Cooperative Banks NAFSCOB, he stressed on increasing the number of primary agriculture credit societies PACS from nearly 1 lakh to 3 lakh over the next five years.PACS are the soul of our agriculture credit system.

- Country:

- India

Cooperation Minister Amit Shah on Friday made a case for expanding the network of primary agriculture credit societies to every 'panchayat' with an aim to increase agri-finance to Rs 10 lakh crore annually through cooperatives.

While addressing a national conference on rural cooperative banks organised by Ministry of Cooperation and the National Federation of State Cooperative Banks (NAFSCOB), he stressed on increasing the number of primary agriculture credit societies (PACS) from nearly 1 lakh to 3 lakh over the next five years.

''PACS are the soul of our agriculture credit system. Until PACS work in a good manner, our agricultural system cannot work properly. It is equally important to expand the PACS outreach,'' Shah said.

The minister stated that there are 3 lakh panchayats in the country, while the number of PACS is about 95,000 currently, of which about 65,000 are functional.

''Still there are 2 lakh panchayats that do not have any PACS,'' Shah said, and exhorted senior officials of State Cooperative Banks (SCBs) and District Central Cooperative Banks (DCCBs) to set a five-year strategy in this regard.

Every district cooperative bank should think how to create one single PACS in a panchayat and every state cooperative bank should monitor that strategy while NABARD should verify those strategies, the minister said.

Shah pointed out that agriculture finance through cooperatives has been declining over the years. Nearly 65,000 functional PACS are doing agriculture finance of Rs 2 lakh crore.

''There are around 13 crore PACS members of which around 5 crore members take credit. These PACS disburse about Rs 2 lakh crore credit every year.

''Suppose this gets multiplied by five, right now we have 65,000 well functioning PACS, if we can make as many as 3 lakh PACS that work well, then this Rs 2 lakh crore credit disbursal can become Rs 10 lakh crore,'' the minister said.

He asked SCBs and DCCBs to aim for Rs 10 lakh crore agri- finance through PACS in the cooperatives.

The minister highlighted that the Cabinet Committee on Economic Affairs has approved computerisation of PACS to improve their efficiency and to bring transparency and accountability in their operations.

This project proposes computerisation of about 63,000 functional PACS over a period of 5 years with a total budget outlay of Rs 2,516 crore with the Centre's share of Rs 1,528 crore.

The computerisation of PACS will have many benefits including improvement in accounting and auditing system as well as upgrade skills of human resources.

The minister also asked PACS to increase their outreach and bring more farmers in their fold.

Shah said it is futile to complain about RBI unless the cooperative credit societies reform themselves.

''We should aim to expand the outreach of PACS for farmers as they still take a humanitarian approach towards farmers while financing them and are not ruthless,'' he added.

Seeking to strengthen PACS and make them viable, Shah said the ministry has floated a draft ‘Model Bye-laws of PACS’ on which it has invited suggestions from state governments and other stakeholders.

He said suggestions have come and the government will soon finalise the model bye-laws, which propose to allow PACS to undertake various activities like dealership of petroleum products and running PDS shops.

The minister stressed on making PACS viable and said the bye-laws propose to allow them to undertake 22 new activities.

PACS constitute the lowest tier of the three-tier short-term cooperative credit (STCC) in the country comprising about 13 crore farmers as its members, which is crucial for the development of the rural economy.

Besides model bye-laws for PACs, Shah said the government is working on a new cooperation policy, setting up a university as well as an export house and developing a database of cooperatives.

He said the ministry is also working towards creating a platform so that the stakeholders can register their issues and complaints under the framework.

It will help in flow of communication right from the level of villages to districts, states and then to the central government, he added.

Shah highlighted that India's cooperative movement is almost 120 years old and has accomplished many achievements, but ''we also have to reflect back to see what we have lost.'' The cooperative movement has become uneven, while it is flourishing in some states, it is either struggling or only on papers in other states.

To promote cooperative movement and to expand it across all panchayats and tehsils in the country, Shah called for devising a different strategy.

Shah also presented performance awards to select SCBs/ DCCBs/PACS, and felicitated a few short-term cooperative credit institutions for 100 years of service.

At the event, Union Minister of State for Cooperation B L Verma, Cooperation Secretary Gyanesh Kumar, NAFSCOB Chairman Konduru Ravinder Rao, NAFSCOB's MD Bhima Subrahmanyam, NCUI President Dileep Sanghani, Kribhco Chairman Chandra Pal Singh Yadav and NAFED Chairman Bijender Singh were present.

On Thursday, the ministry said in a statement, the short-term cooperative credit structure in India comprises 34 SCBs, 351 DCCBs and 96,575 PACS.

NAFSCOB was established on May 19, 1964 with the broad objective of facilitating the operations of State and Central Cooperative Banks and development of short-term cooperative credit structure.

NAFSCOB provides a common forum to its members and their affiliates/ shareholders/ owners to project their achievements, focus their concerns and promote their interests.

(This story has not been edited by Devdiscourse staff and is auto-generated from a syndicated feed.)

- READ MORE ON:

- Amit Shah

- Konduru Ravinder Rao

- Ministry of Cooperation

- Dileep Sanghani

- Central Cooperative Banks

- cooperatives

- Pal Singh Yadav

- Gyanesh Kumar

- NABARD

- PACS

- NCUI

- National Federation of State Cooperative Banks

- NAFSCOB

- NAFED

- Shah

- Kribhco

- Bijender Singh

- State

- State Cooperative Banks

- Cabinet Committee on Economic Affairs

ALSO READ

INSIGHT-Chinese state media stoked allegation Taiwan's president would flee war

WHO Member States agree to resume negotiations on finalizing pandemic agreement

World News Roundup: Erdogan vows to make amends after humbling election loss in Turkey; Chinese state media stoked allegation Taiwan's president would flee war and more

Madhya Pradesh: "Due to fear of defeat, Digvijaya Singh want election through ballot paper," says state BJP chief VD Sharma

Tripura improves position in Law and order, now third among states with least crime, says CM Saha