TSMC's Stellar Performance Sparks Wall Street Rally Amid Geopolitical Uncertainty

Taiwan's TSMC posted a significant profit increase, lifting U.S. and European markets. The easing of geopolitical tensions with Iran and positive macroeconomic indicators boosted investor sentiment. Oil prices fell, while the financial sector saw stock gains, including substantial rises for BlackRock and Goldman Sachs. U.S. Treasury yields increased slightly.

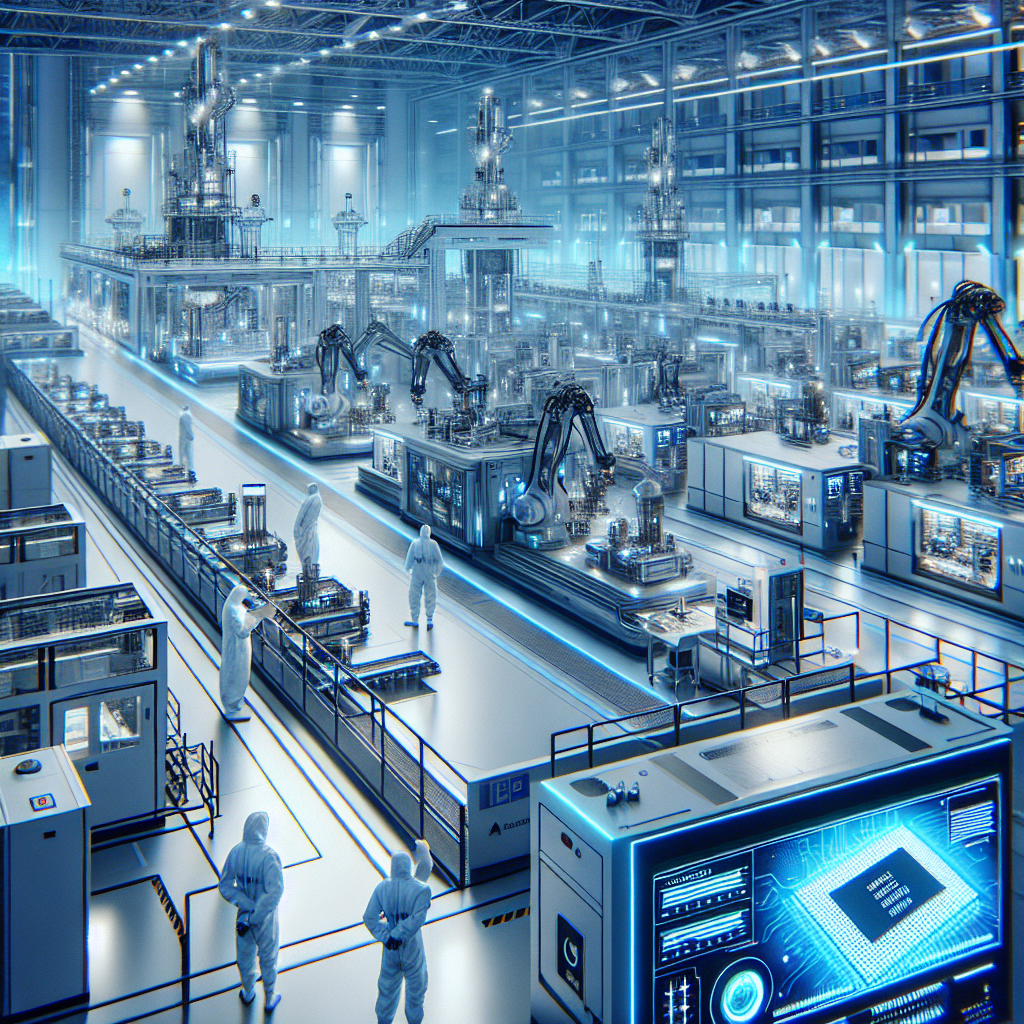

TSMC, the world's largest advanced AI chipmaker, reported a 35% profit surge, pushing Wall Street into positive territory after consecutive losses. The news prompted a record high in U.S.-listed shares of TSMC, buoying related tech companies like ASML, a significant TSMC customer.

Investors were encouraged by President Trump's decision to allow Nvidia to sell AI chips to China, alongside rising U.S. stock indexes. BlackRock's shares climbed following better-than-expected earnings, while Goldman Sachs' stock rose despite early investment banking fee shortfalls.

Meanwhile, softer geopolitical risks and strong U.S. economic data, including falling unemployment claims, led to lower oil and gold prices and heightened U.S. Treasury yields. Federal Reserve discussions on inflation control continue as the market assesses future interest rate cuts.

(With inputs from agencies.)

ALSO READ

Rising Tides: Investment Banks Gear Up for a Blockbuster 2026

Goldman Sachs' Profit Surges Amid Booming M&A Market and Wealth Management Growth

Goldman Sachs Surges With Record Profits and Strategic Moves

Goldman Sachs Exceeds Expectations Amid Market Turmoil

Goldman Sachs Surges on Strong Trading and M&A Gains