Cash Incentives Boost Insurance Enrollment but Fail to Secure Long-Term Retention in Thailand

A study on Thailand’s social insurance program found that cash incentives significantly boosted enrollment among informal workers, but retention was low, as many valued the immediate cash benefit over long-term insurance. This suggests that low perceived value, rather than administrative barriers, hinders sustained participation in social insurance.

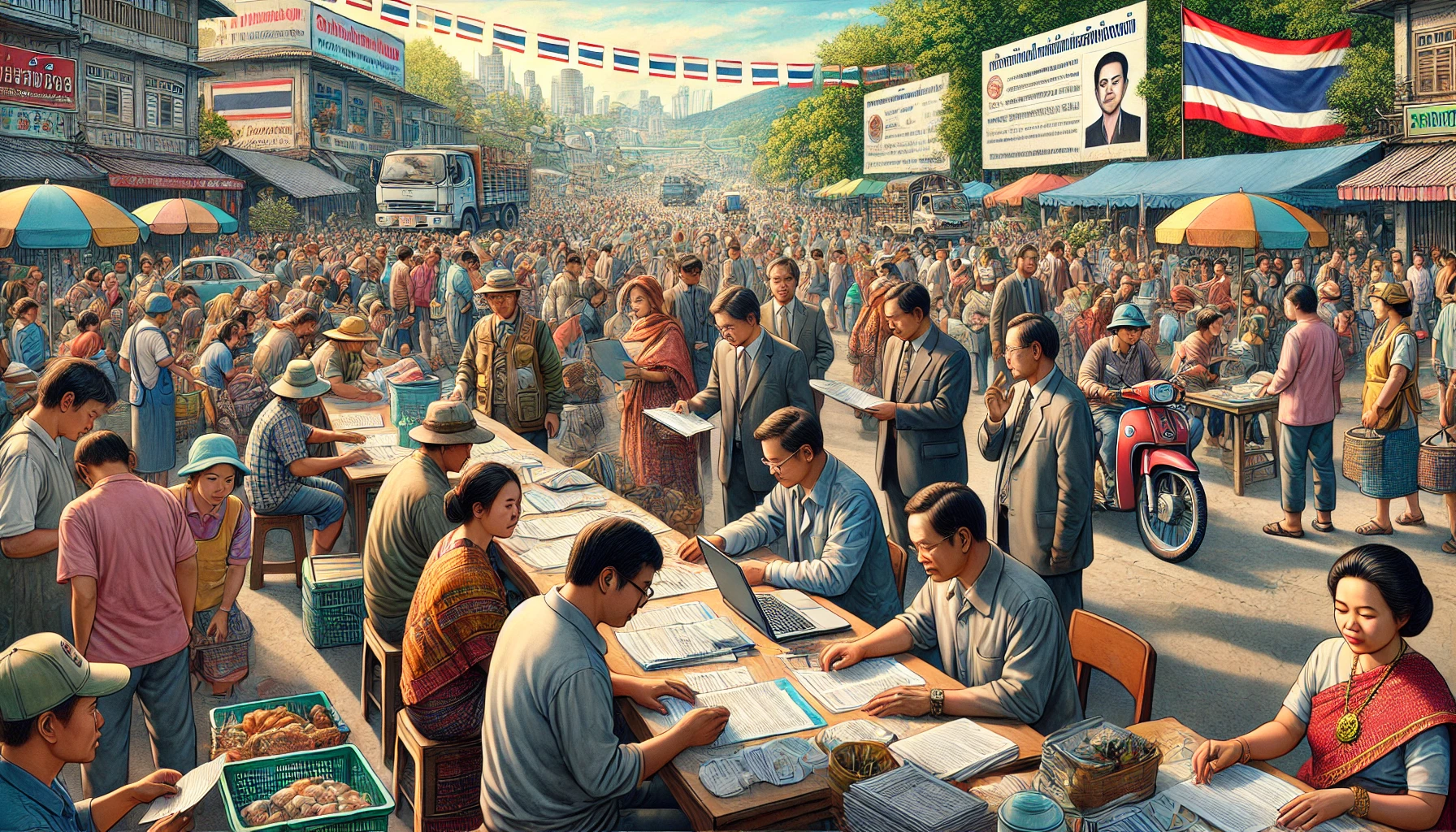

In a recent working paper from the National Bureau of Economic Research, researchers Rema Hanna from Harvard University, Benjamin Olken from MIT, Phitawat Poonpolkul, and Nada Wasi from the Puey Ungphakorn Institute for Economic Research explored a key issue in social insurance: understanding the barriers that prevent informal workers from enrolling in these programs. In many countries with large informal sectors, enrolling workers in social insurance schemes is a challenging task, and Thailand is no exception. The Thai government attempted a bold experiment to address this during the COVID-19 pandemic by offering substantial cash incentives to informal workers to encourage their enrollment in a voluntary social insurance program. This initiative allowed researchers to analyze whether barriers to enrollment were primarily administrative, informational, or related to a perceived low value of the insurance itself. This study sheds light on what may drive low take-up of social insurance programs in developing countries and how these barriers could potentially be addressed.

Cash Incentives Trigger Enrollment Surge

The Thai government’s experiment took place in 2021, at the height of the pandemic, when informal workers in 29 of Thailand’s 77 provinces were offered a one-time payment of 5,000 THB (about USD 135) if they enrolled in the voluntary Social Security Article 40 program. In some provinces, this incentive was doubled to cover two months, totaling 10,000 THB, which is a substantial amount considering the minimum wage in Thailand is roughly 3,000 THB per month. Social Security Article 40 was designed to cover informal workers who do not contribute through payroll taxes due to their informal employment status. The program offers different tiers of benefits, including coverage for income loss from illness or injury, disability compensation, and in higher tiers, a small pension and child allowance. Typically, participation in this program has been low, and understanding why informal workers are reluctant to join was a key focus of the study.

Enrollment Increases, But Retention Falls

The incentive had an immediate and dramatic effect on enrollment, as the number of new participants in Article 40 skyrocketed. In just two months, over six million informal workers enrolled, increasing the coverage rate from about 6% of the informal workforce to an impressive 73% in the provinces where the incentives were offered. This surge in enrollment demonstrated that Thailand’s administrative infrastructure was capable of handling a large influx of participants, and it suggested that logistical barriers were not the primary reason for low enrollment in the past. It became clear that when given a strong enough incentive, informal workers would overcome any minor administrative challenges to sign up for the program.

However, a significant drop in retention among these new enrollees soon followed. Within six months, only 24% of the newly enrolled individuals were still participating in the program, and by the one-year mark, just 13% were still paying their monthly premiums. This was a stark contrast to the retention rate among those who had enrolled before the incentive was introduced, which stood at 53% after six months and 43% after a year. The researchers investigated why so many individuals left the program after receiving the incentive. A key finding was that many of these enrollees chose the least expensive insurance tier, which offered the fewest benefits, indicating that they may have had little interest in the program’s long-term offerings and primarily enrolled to receive the immediate cash benefit.

Choosing the Lowest Tier Reflects Low Valuation of Benefits

To better understand these decisions, the researchers looked at the choices enrollees made among the program’s three insurance tiers. Article 40 offers a basic tier for a low monthly premium that covers only income loss from injury, a second tier that includes a small pension, and a third, more expensive tier with additional child allowance benefits. The majority of incentive-driven enrollees selected the lowest tier, suggesting that they valued the immediate cash incentive far more than the insurance coverage itself. The team developed a model to estimate the participants’ willingness to pay for the insurance benefits based on their choice of tiers, finding that those who enrolled without the incentive had a significantly higher willingness to pay than those who enrolled during the incentive period. This indicates that many of the new enrollees likely joined the program only for the immediate cash benefit, rather than because they valued the insurance product’s future benefits.

Implications for Policy and Future Research

These results suggest that administrative or informational barriers are not the main reasons for low enrollment in social insurance programs among informal workers. Instead, the low take-up appears to stem from a low perceived value of the insurance itself. The incentive proved effective in driving initial enrollment, but it attracted individuals who were not interested in long-term participation. Once they received the financial incentive, most were willing to let their insurance lapse, especially since they had opted for the lowest tier, which did not require a long-term commitment.

The findings of this study have important implications for policymakers who aim to increase enrollment in social insurance programs in countries with large informal sectors. The Thai experiment suggests that while one-time incentives can increase enrollment temporarily, they may not be effective in fostering sustained participation. Policymakers might need to re-evaluate the design of social insurance programs to ensure they offer real value to informal workers, potentially by improving benefits or making them more relevant to this group’s needs. Additionally, future research could explore whether alternative program designs or restructuring of benefits would be more appealing to potential enrollees, fostering longer-term participation without relying solely on temporary financial incentives.

- FIRST PUBLISHED IN:

- Devdiscourse