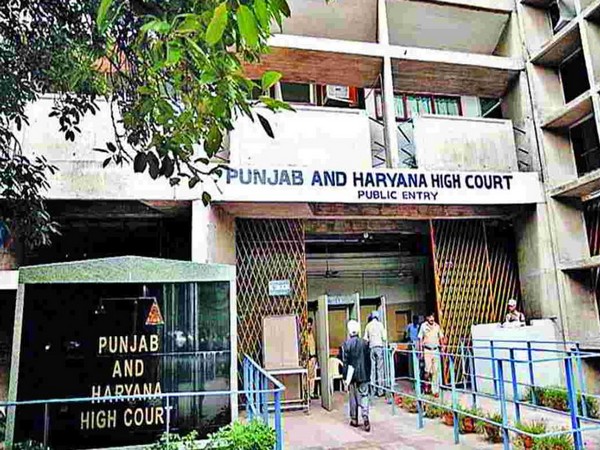

PIL filed in Punjab and Haryana HC against income tax exemption to MLAs

A public interest litigation (PIL) has been filed in the Punjab and Haryana High Court challenging the income tax exemption granted to MLAs of Punjab on their salaries and allowances.

- Country:

- India

A public interest litigation (PIL) has been filed in the Punjab and Haryana High Court challenging the income tax exemption granted to MLAs of Punjab on their salaries and allowances. "The state of Punjab is not in a position to pay salaries of its employees, while the MLAs are exempted from the payment of income tax on their salaries and allowances," reads the PIL filed by advocate HC Arora.

A Division Bench of Justice Rajiv Sharma and Justice HS Sidhu heard the matter on Friday and adjourned the PIL till December 5 to enable the petitioner to argue as to whether the state assembly is competent to enact a law granting exemption to MLAs from paying income tax. In the petition, Arora stated that as per a letter written by Finance Minister Manpreet Singh Badal to Punjab Chief Minister Captain Amarinder Singh, which has been reported in the press, the state is in a financial crunch and is not even in a position to pay salaries to its employees.

"On the other hand, under Section 3-AA of the Punjab Legislative Assembly (Salaries and Allowances of Members) Amendment Act, 2004. The salaries and allowances payable to the members under this Act, shall be exclusive of the income tax, payable in respect thereof under any law relating to income tax for the time being in force, and such tax shall be paid by the State Government," it said. The petitioner has also stated that the office of the Punjab Chief Minister has informed that the annual burden of total income tax payable on the salaries of MLAs is Rs 10.72 crore.

He stated that earlier Ministers and Deputy Ministers were also exempted from paying income tax on their salaries and allowances, but through appropriate amendments in relevant legislation the provision for giving them such exemption has been withdrawn. "The continuance of such exemption to MLAs, beyond April 27, 2018, is totally arbitrary and unjustified. The provisions of Section 3-AA (Supra) therefore, are liable to be quashed," the petitioner said.

Answering a question by the bench, Arora said: "Every taxpayer is aggrieved. I am myself highly aggrieved, as I am annually paying income tax of more than Rs 10 lakh. Tax payers are paying income tax through their nose." (ANI)

(This story has not been edited by Devdiscourse staff and is auto-generated from a syndicated feed.)

ALSO READ

BJP MLAs demanding discussion on 'irregularities' in DJB marshalled out of Delhi Assembly

Inconsistent Punjab face unpredictable SRH in mid-table IPL clash

BSP names Punjab AAP MLA's father as candidate from Ferozepur LS seat

LS polls: SAD (Amritsar) fields slain gangster's father from Punjab's Ferozepur

BJP MLAs forcefully removed from Delhi Assembly after requesting discussion on DJB 'irregularities'