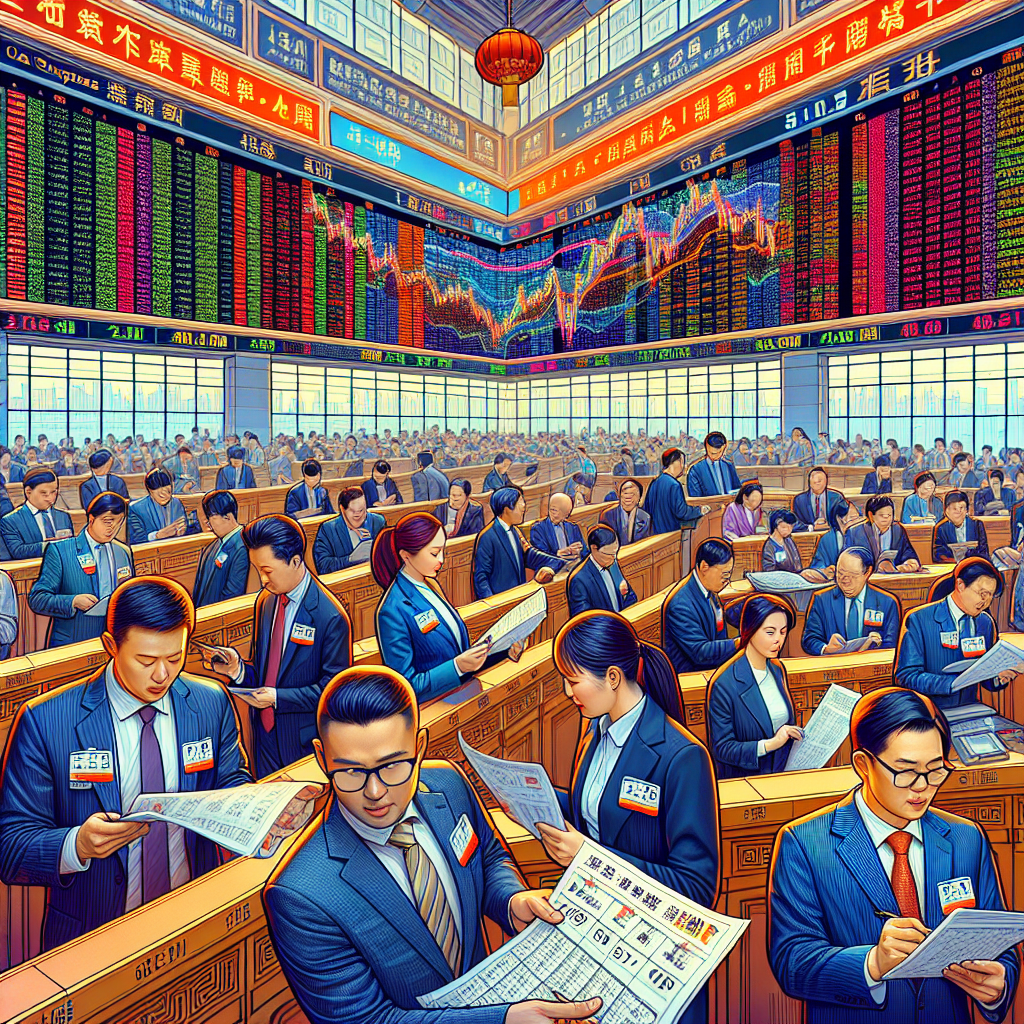

Chinese Stock Market Dips Amid Nvidia-Chip Concerns

Chinese shares hit a six-week low, spurred by concerns over US decisions on Nvidia's H200 chip sales to China. The market saw widespread declines, particularly in chip-related stocks. Analysts suggest a short-term correction, though the downside remains limited before the upcoming Central Economic Work Conference.

On Monday, Chinese shares plummeted to a six-week low, largely driven by a Reuters report indicating that the United States may allow Nvidia to sell its H200 chips to China. This sparked a broad-based sell-off, particularly affecting chip-related stocks.

The Shanghai Composite index fell by 0.3% to 3,821.68. Blue-chip stocks in the CSI300 index dropped 0.6%, while the CSI AI Index declined by 1.2%. AI chip maker Cambricon suffered a 2.5% drop, further compounding this month's losses to approximately 10%.

Meanwhile, the rare earths sector weakened by 1.3%. However, Hong Kong's Hang Seng China Enterprises Index and Hang Seng Index both posted gains. Market sentiment took a positive turn after Federal Reserve policymaker John Williams indicated potential interest rate cuts in the near term.

(With inputs from agencies.)