Semiconductor Surge Boosts U.S. Stock Futures Amid Earnings Season

U.S. stock futures rose on TSMC's strong results, indicating robust growth and increased U.S. manufacturing capacity. This lifted U.S. chip toolmaker shares. Investors focused on financial earnings, amid concerns over a proposed credit card interest cap. Fundamental analysis remains crucial as earnings season progresses.

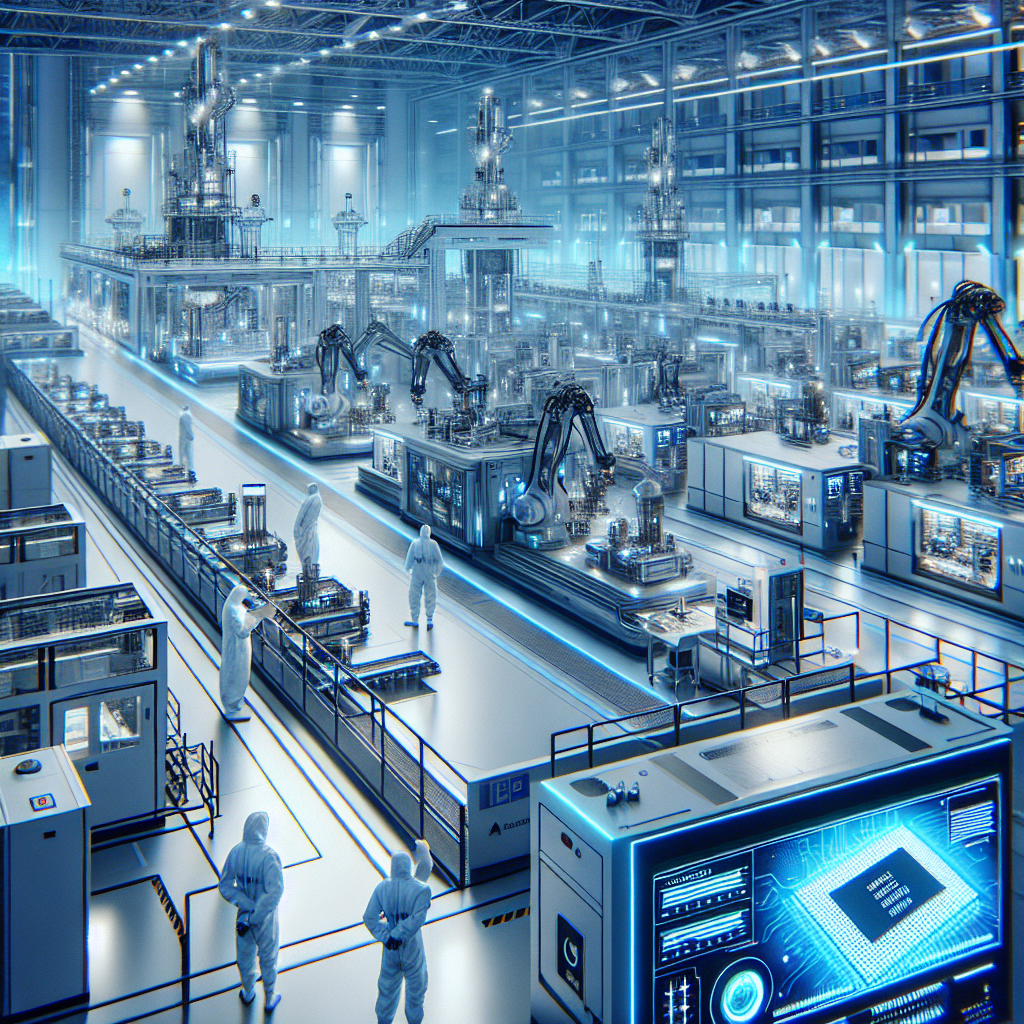

U.S. stock index futures rallied on Thursday, buoyed by Taiwan Semiconductor Manufacturing Company's (TSMC) impressive quarterly performance. As the main producer of advanced AI chips, TSMC's strong growth outlook and plans for expanding U.S. manufacturing capacity propelled gains in semiconductor-related stocks, including Applied Materials, Lam Research, and KLA.

Financial stocks, however, faced pressure ahead of earnings reports from major Wall Street firms, with BlackRock, Goldman Sachs, and Morgan Stanley showing mixed premarket activities. Concerns about a proposed cap on credit card interest rates at 10% also stirred unease, despite banks posting solid profit growth.

In the broader market, investors shifted from high-valued tech and growth stocks to undervalued sectors, lifting the S&P 500 materials and industrials indexes to new highs. As the earnings season unfolds, investors are scrutinizing company fundamentals, looking for indicators of sustained market strength, while coming weekly jobless claims data could add more insight into the economic landscape.

(With inputs from agencies.)