Nasdaq and S&P Futures Rise Amid TSMC's Strong Results

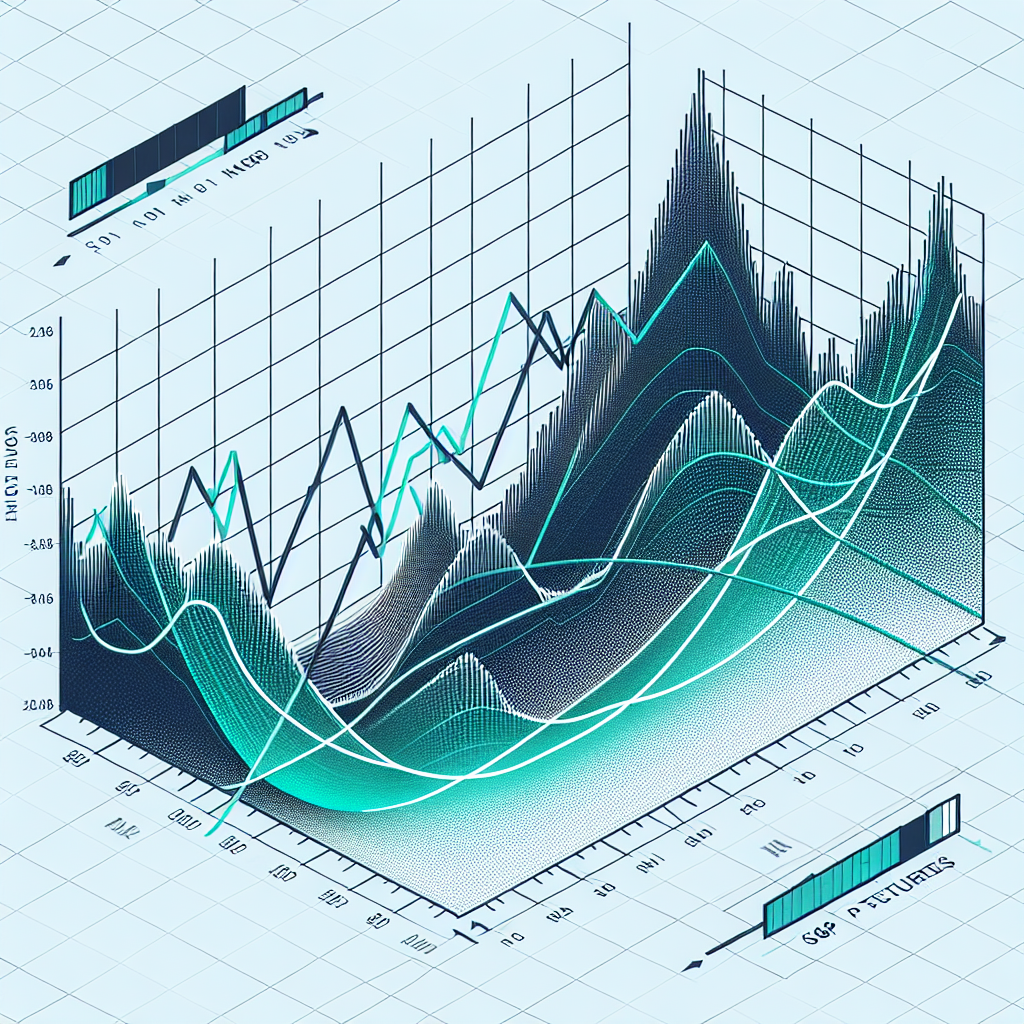

Nasdaq and S&P 500 futures climbed following TSMC's robust results, boosting U.S. chipmakers. Tension around the Federal Reserve's independence remains with President Trump's criticisms. Market odds for a September rate cut increased. Investors anticipate retail sales data for consumer spending insights.

In early trading on Thursday, futures linked to the Nasdaq and S&P 500 indexes advanced following impressive earnings from Taiwan's TSMC, providing a lift to semiconductor stocks amid market concerns over Federal Reserve autonomy.

By 5:45 a.m. ET, the Dow E-minis had slipped 24 points or 0.05%, while the S&P 500 and Nasdaq 100 E-minis climbed 5.75 points or 0.1%, and 41.25 points or 0.18%, respectively. This uptick came as TSMC, a global leader in advanced AI chip manufacturing, announced record quarterly profits, spurred by rising demand in the AI sector.

Tension lingers on Wall Street following reports that President Trump considered dismissing Federal Reserve Chair Jerome Powell, despite his denial, as investors remain anxious over the Fed's decisions on interest rates. Focus also turns to upcoming data releases, including June retail sales figures, for further economic indicators.

(With inputs from agencies.)

- READ MORE ON:

- Nasdaq

- S&P 500

- TSMC

- chipmakers

- Federal Reserve

- Trump

- interest rates

- retail sales

- AI chips

- investors

ALSO READ

Trump's Federal Fund Freeze Sparks Democratic Outrage

US Supreme Court to Rule on Trump's Tariffs Amid Domestic Legal Battles

Trump's Greenland Ambitions: National Security and Strategic Interests

Trump's Controversial Greenland Proposal: A New Frontier for U.S. Influence?

Trump's Greenland Gambit: Strategic Arctic Ambitions Unveiled