Global Currencies React to Central Bank Decisions

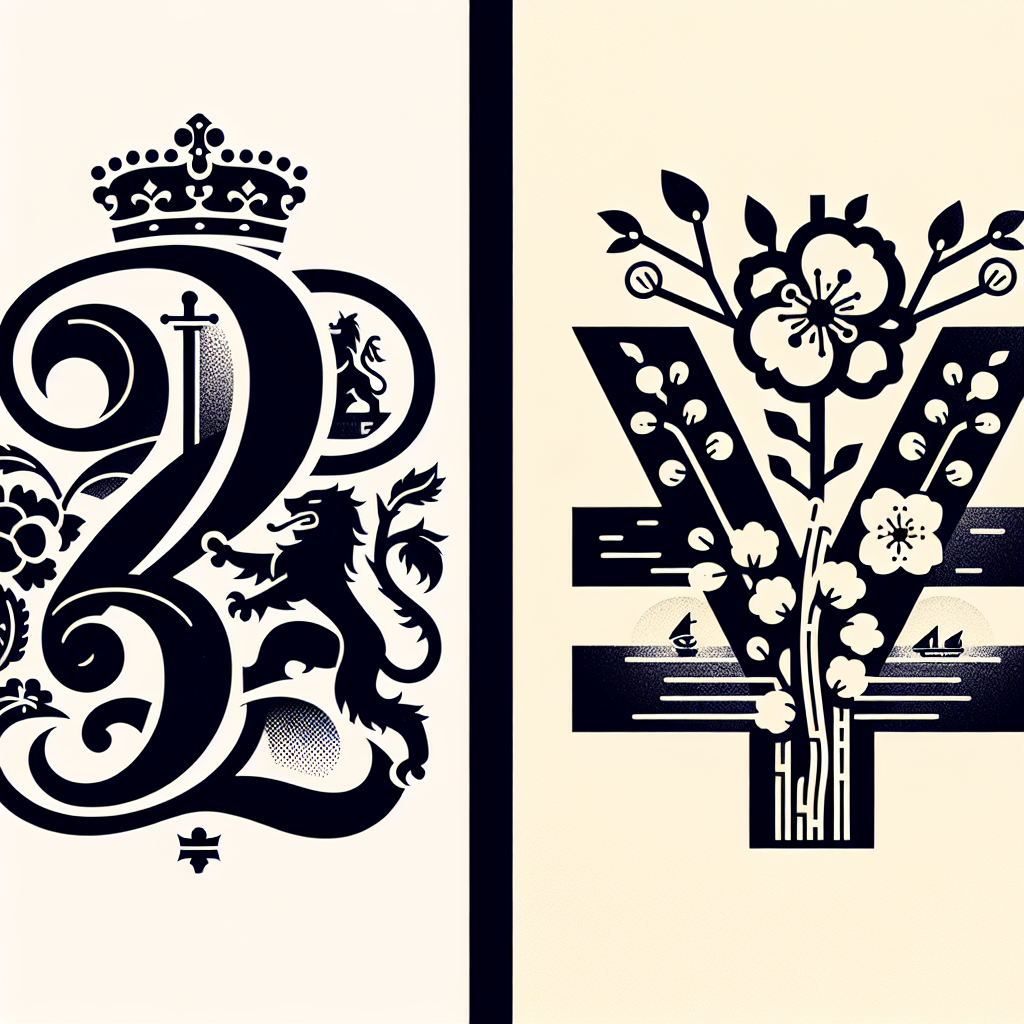

The yen fell after the Bank of Japan's rate hike decision, as investors awaited further details from Governor Kazuo Ueda. The euro and sterling rose against the yen, influenced by central bank actions. Uncertainty surrounds the dollar following US inflation data, and Bitcoin remains under $90,000.

In turbulent trading, the yen experienced a slight drop on Friday following the Bank of Japan's policy announcement. Investors kept a keen eye on Governor Kazuo Ueda's expected remarks to gauge the future path of interest rate hikes, with the yen dipping over 0.3% to 156.02 per dollar.

The euro and sterling strengthened against the yen, driven by their respective gains and currency fluctuations. The BoJ's move to raise its policy rate to 0.75% was widely anticipated, influencing the yen's trajectory. Attention turns to Ueda's upcoming press briefing for clearer insights.

Elsewhere, the US dollar briefly weakened amid unexpected inflation data, with skepticism remaining due to data collection interruptions. Meanwhile, the Bank of England's closer-than-expected rate cut decision limited sterling's movement, while Norway and Sweden maintained unchanged rates.

(With inputs from agencies.)

ALSO READ

Remembering Age Hareide: A Legacy in European Football

Sweeping Defense Bill Signed Amidst European Security Debate

EU leaders agree to provide 90 billion euros to Ukraine over the next two years, summit chairman says, reports AP.

EU delays massive free-trade deal with South American bloc Mercosur, European Commission says, reports AP.

European Markets Surge Amid Positive Economic Signals