Currency Shifts: Yen Rises Amid Global Rate Changes

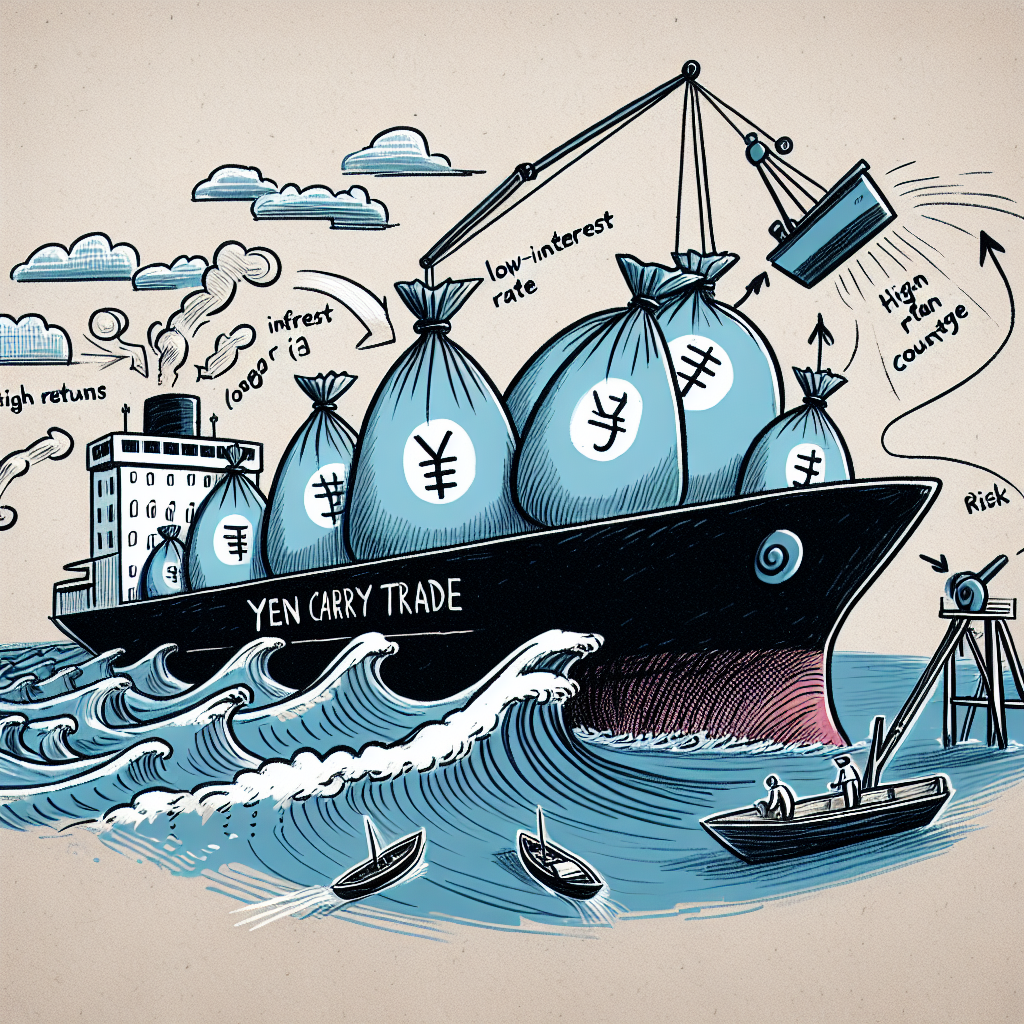

The yen strengthened as Japan stays poised for rate hikes, while the European Central Bank continues cuts amid weak economic data. The euro and the dollar fell against the yen. Meanwhile, U.S. economic growth slowed, and Brazil increased interest rates, diverging from the trend of other central banks.

The yen surged on Thursday, benefiting from a distinctive position of continued interest rate hikes by Japan, set against a backdrop where global counterparts, like the European Central Bank, are reducing rates. The yen's strength was apparent as the dollar fell 0.69% to 154.13 yen, and the euro decreased 0.81% to 160.38 yen.

The ECB cut borrowing costs by a further 25 basis points amid concerns over sluggish economic growth, despite facing persistent inflation. Germany's unexpected economic contraction in Q4 did little to alter the euro's course against the dollar, which dipped slightly to $1.0403.

Global economic strategies revealed stark contrasts, with Japan's central bank maintaining its rate hike trajectory, and Brazil's significant one-point rate increase. In contrast, Canada and Sweden mirrored the ECB's easing spree, while U.S. GDP growth showed a deceleration, impacting the dollar index.

(With inputs from agencies.)

- READ MORE ON:

- yen

- currency

- interest rates

- ECB

- Japan

- dollar

- euro

- economic growth

- Federal Reserve

- Brazil

ALSO READ

European Powers Respond to Middle East Crisis Amid US-Israeli Strikes on Iran

Surging Migrant Crossings Turn Crete into Europe's New Pressure Point

Strengthening Ties: Japan Eyes Semiconductor Growth in Assam

Uttar Pradesh Leads Green Hydrogen Revolution with Japanese Collaboration

Poland's Nuclear Dilemma: Balancing European and U.S. Alliances