Turkish lira hits record low, stocks gain after Erdogan secures re-election

Meanwhile, in a sign of relief that the electoral uncertainty is now over, stocks gained with the benchmark BIST-100 index ending the day up 4.10% and the banking index closing up 2.13%. The share of foreign asset managers holding Turkish stocks has dwindled in recent years, with local investors chiefly driving the market.

- Country:

- Turkey

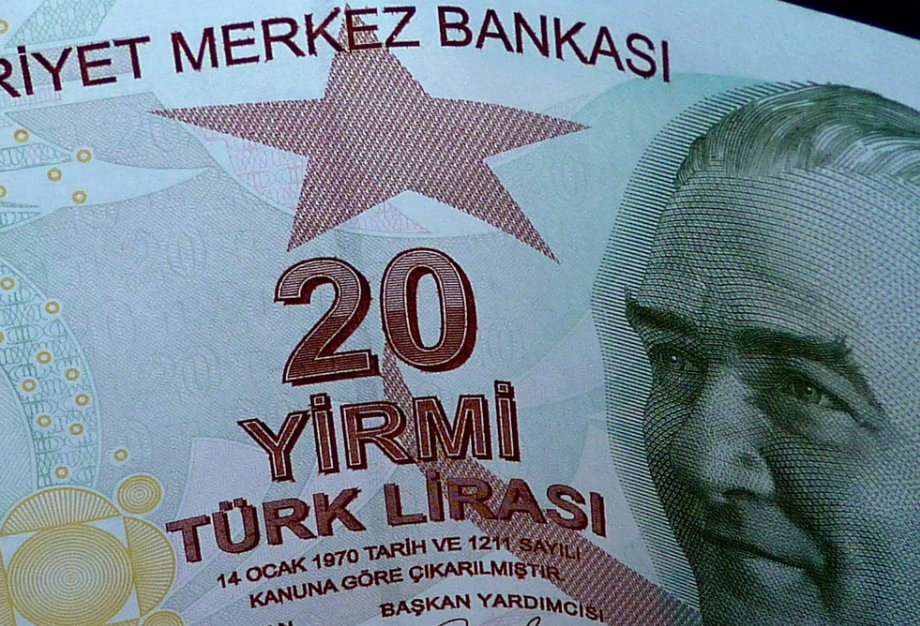

Turkey's lira hit fresh record lows against the dollar on Monday, though stocks rallied, after President Tayyip Erdogan secured victory in Sunday's presidential election, extending his increasingly authoritarian rule into a third decade. Erdogan prevailed despite years of economic turmoil that critics blame on his unorthodox economic policies, which the opposition had pledged to reverse.

The lira weakened to 20.1050 to the dollar during its worst trading day in eight months, breaking through the previous record low touched on Friday. The lira has slumped more than 7% since the start of the year, and lost more than 90% of its value over the past decade, with the economy in the grip of boom-and-bust cycles and rampant bouts of inflation.

"In the absence of a U-turn in his economic policies, the risk of an acute currency crisis looms," Danske Bank chief analyst Minna Kuusisto said of Erdogan. After a currency crisis in 2021, Turkish authorities took an increasingly hands-on role in foreign exchange markets. Daily moves became unnaturally small while FX and gold reserves dwindled.

The lira has moved more than 0.25% only a handful of days since early November, making Monday's 0.58% drop notable. Meanwhile, in a sign of relief that the electoral uncertainty is now over, stocks gained with the benchmark BIST-100 index ending the day up 4.10% and the banking index closing up 2.13%.

The share of foreign asset managers holding Turkish stocks has dwindled in recent years, with local investors chiefly driving the market. Still, analysts said it would be tough to hold the gains amid broader economic troubles.

"I was expecting a short-lived rally once the uncertainty of regarding the elections ended," said investment strategist Tunc Satiroglu, adding that he expected the bear market to return. Erdogan's surprisingly strong showing in the first round of the election on May 14 had triggered a selloff in Turkey's international bonds and a spike in costs to insure exposure to its debt via credit default swaps (CDS) amid fading hopes of a change in economic policy.

The nation's dollar bonds slipped to their lowest in at least six months last week, while CDS rose to a seven-month high. On Monday, Turkey's international bonds were steady, with U.S. and many European markets closed for holidays, while CDS were hovering at Friday's closing level. "The election outcome, with Erdogan securing a solid majority, suggests a continuation of policies that have contributed to a decline in the country's fundamentals," said Jeff Grills, head of emerging market debt at Aegon Asset Management.

"The depreciation of the lira and the strain on already low reserves add to the concerns for bond investors."

(This story has not been edited by Devdiscourse staff and is auto-generated from a syndicated feed.)