From Credit to Crisis: How Supply Shocks Affect Employment and Investment

The European Central Bank's analysis reveals that credit supply shocks significantly impact employment and firm behavior, leading to job losses and reduced investment, particularly in sectors reliant on external financing. Policymakers are urged to enhance credit availability to mitigate these adverse effects and support economic stability.

In a detailed analysis, the European Central Bank (ECB) delves into the significant effects of credit supply shocks on employment and firm behavior. This research is crucial in understanding how fluctuations in credit availability can profoundly influence economic outcomes, particularly during periods of financial instability. The findings underscore the interconnectedness of credit markets and the broader economy, highlighting the need for effective policy responses to mitigate adverse effects.

Understanding Credit Supply Shocks

Credit supply shocks are defined as sudden changes in the availability of credit, which can arise from various factors, including financial crises, shifts in monetary policy, or changes in lender behavior. These shocks can have far-reaching consequences for firms, affecting their ability to finance operations and investments. When credit becomes scarce, businesses may struggle to secure the necessary funds to maintain their activities, leading to a cascade of negative effects throughout the economy.

Employment Consequences

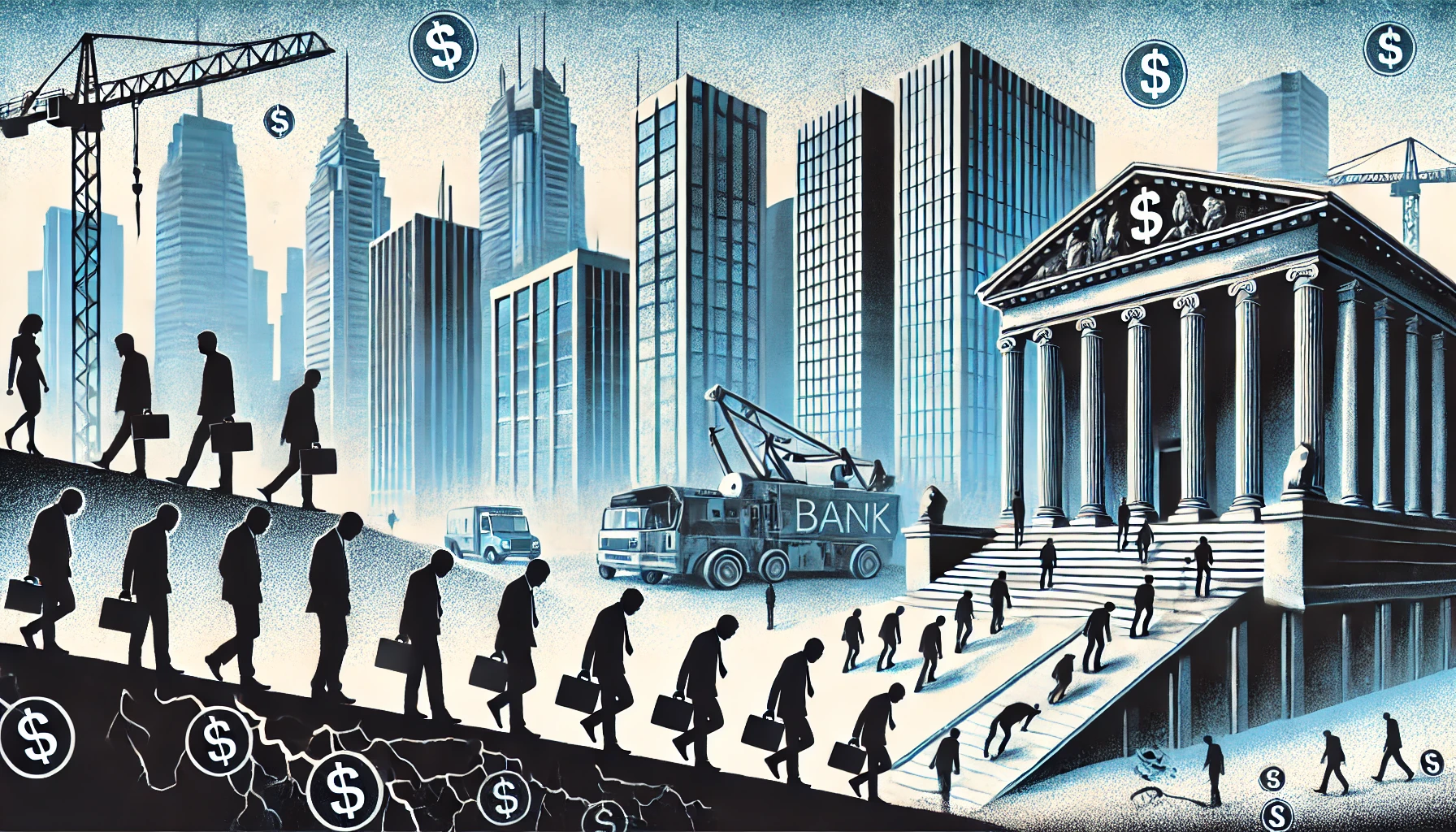

One of the most critical findings of the ECB's analysis is the direct and substantial impact of credit supply shocks on employment levels. When firms face difficulties in obtaining credit, they often respond by reducing their workforce or postponing hiring initiatives. This reaction leads to increased unemployment rates, particularly in sectors that heavily rely on external financing. The research highlights that during periods of tightened credit, vulnerable workers are often the first to feel the pinch, exacerbating economic inequality.

The analysis reveals that the effects of credit supply shocks are particularly pronounced in industries such as construction and manufacturing, where access to financing is crucial for ongoing operations. In these sectors, firms may be forced to lay off employees or implement hiring freezes, resulting in a ripple effect that can impact local economies and communities. The loss of jobs not only affects individual workers but also reduces overall consumer spending, further straining economic growth.

Firm Behavior Under Credit Constraints

The document emphasizes that firms facing credit constraints tend to curtail investment and operational expenditures. This reduction in spending can stifle growth and innovation, leading to long-term negative effects on productivity and competitiveness. The analysis indicates that firms may also resort to cost-cutting measures, which can include layoffs and reduced wages, further impacting the overall economy.

Moreover, the research highlights that firms may prioritize short-term survival over long-term strategic planning when faced with credit supply shocks. This shift in focus can hinder their ability to invest in research and development, employee training, and other initiatives that drive innovation and growth. As a result, the long-term competitiveness of these firms may be compromised, leading to a less dynamic economy overall.

Sectoral Vulnerabilities

The effects of credit supply shocks are not uniform across all sectors. Industries that depend more on external financing, such as construction and manufacturing, are particularly susceptible to credit fluctuations. In contrast, firms with stronger internal cash flows or those operating in less capital-intensive sectors may be less affected. This disparity underscores the need for targeted policy interventions that consider the unique challenges faced by different industries.

For instance, small and medium-sized enterprises (SMEs) often face greater difficulties in accessing credit compared to larger corporations. This is due to their limited collateral and perceived higher risk by lenders. As a result, SMEs may be disproportionately affected by credit supply shocks, leading to higher rates of business closures and job losses in this segment of the economy. Policymakers must recognize these vulnerabilities and implement measures to support SMEs during times of economic stress.

Policy Implications for Economic Stability

The findings from the ECB's research underscore the importance of maintaining a stable credit environment to support employment and economic growth. Policymakers are urged to implement measures that enhance credit availability, especially during economic downturns, to mitigate the adverse effects on firms and employment. This could involve adjusting monetary policy to ensure that credit flows remain robust, even in challenging economic conditions.

Additionally, the ECB suggests that regulatory frameworks should be designed to promote lending during periods of economic uncertainty. For example, measures such as loan guarantees or targeted credit programs can help ensure that businesses have access to the financing they need to weather economic storms. By fostering a more resilient credit environment, policymakers can help safeguard jobs and support economic recovery.

Long-term Economic Consequences

The document warns that prolonged credit supply shocks can lead to structural changes in the economy, including shifts in the composition of firms and potential long-term unemployment. The research highlights the need for timely interventions to restore credit flows and prevent lasting damage to the labor market. Without proactive measures, the economy risks entering a cycle of stagnation, where reduced credit availability leads to lower investment, diminished growth, and higher unemployment.

Furthermore, the long-term consequences of credit supply shocks can extend beyond immediate job losses. As firms struggle to secure financing, they may be forced to downsize or close altogether, leading to a loss of skills and expertise in the workforce. This erosion of human capital can have lasting implications for economic productivity and innovation, making it even more challenging for the economy to recover in the future.

The ECB's analysis reveals that credit supply shocks have significant repercussions for employment and firm behavior. The research emphasizes the critical need for effective policy responses to ensure stable credit conditions and support economic resilience. As the global economy continues to navigate uncertainties, understanding the dynamics of credit supply and its impact on employment will be essential for fostering a robust and inclusive economic recovery.

The insights provided by the ECB serve as a vital reminder of the importance of a well-functioning credit market in promoting economic stability. By addressing the challenges posed by credit supply shocks, policymakers can help create an environment that supports sustainable growth and protects the livelihoods of workers across various sectors.

- FIRST PUBLISHED IN:

- Devdiscourse