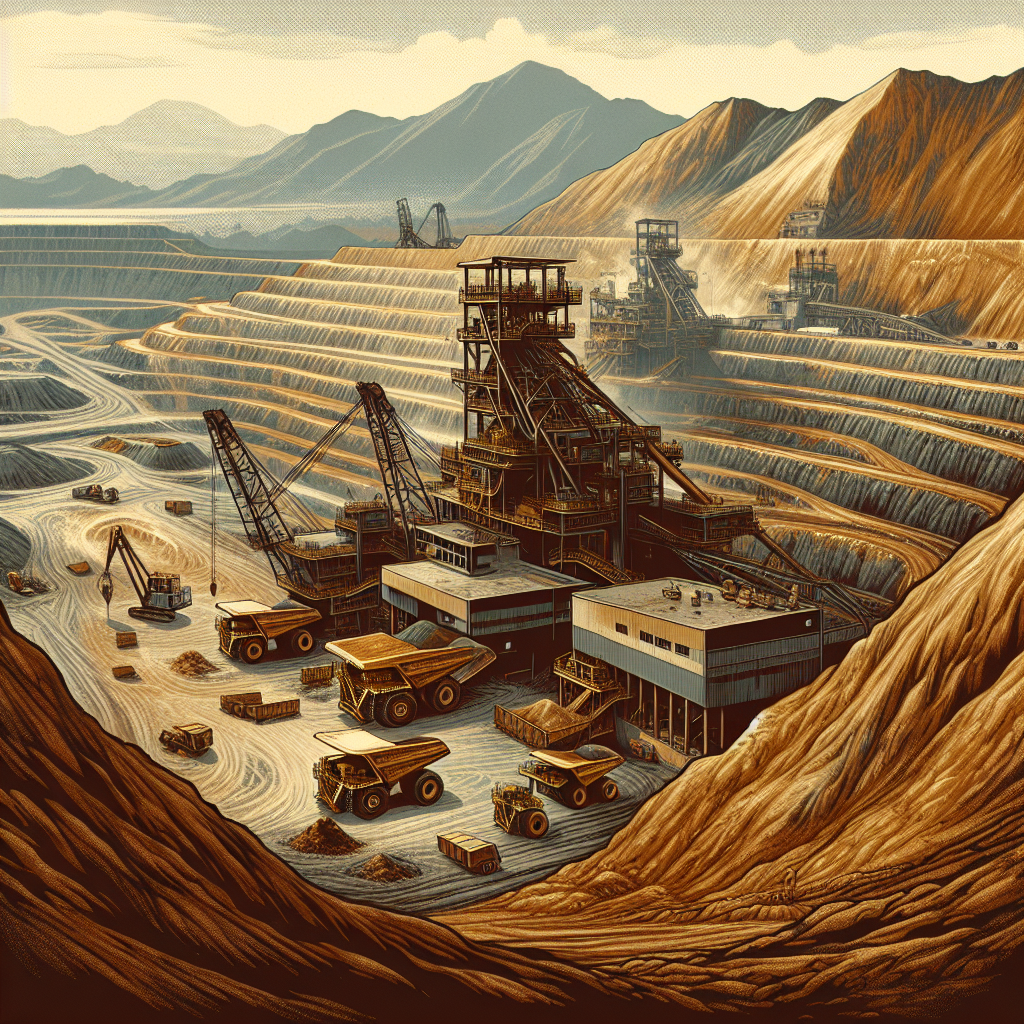

Gold's Volatile Ride: Riding the Waves of Policy and Tariff Uncertainty

Gold prices are set to experience significant volatility due to several global factors. Key influences include tariff deadlines, central bank policy signals, and macroeconomic data. Amidst geopolitical tensions and changes in monetary policy, investors are closely monitoring these developments to anticipate future movements in the gold market.

- Country:

- India

Gold prices are anticipated to become increasingly volatile in the coming weeks as investors focus on pivotal global developments, according to analysts. Elements such as the July 9 tariff deadline and signals from major central banks, including the US Federal Reserve, are expected to heavily influence gold's immediate future.

The suspension of tariffs imposed by former President Trump on imports from several nations, among them India, concludes on July 9. This restoration of a 26% additional duty revives concerns among traders and stakeholders.

Central to investors' watchlist is the anticipated release of the US Fed's FOMC meeting minutes. Analysts believe that fiscal deficit issues and potential tariff decisions might further impact gold's market performance, despite recent gains in precious metal futures and steady support from a weakening US dollar and geopolitical uncertainties.

(With inputs from agencies.)

ALSO READ

NATO's Arctic Ambitions: Military Moves Amid Geopolitical Tensions

European Shares Reach New Heights Amidst Geopolitical Tensions

Stocks Soar to Record Highs Amid Jobs Data and Geopolitical Tensions

U.S. Markets Surge Amid Geopolitical Tensions and Earnings Optimism

Geopolitical Tensions Surge: Naval Drills Off Cape Town Ignite Controversy