Timex Group's Strategic Offer: A Closer Look at the Indian Market Dynamics

Timex Group Luxury Watches BV plans to sell a 15% stake in its Indian entity through an Offer for Sale at a set floor price. Scheduled for end-June 2025, the move involves both non-retail and retail investors. Timex's diverse brand portfolio continues its growth spurt in India.

- Country:

- India

In a strategic financial maneuver, the Timex Group Luxury Watches BV has announced its plan to divest a 15 percent stake in its Indian subsidiary via an Offer for Sale (OFS). The set floor price for this sale is Rs 175 per equity share, notably, 33 percent lower than the recent market closing.

The OFS is scheduled to commence for non-retail investors on Wednesday, followed by retail investors on Thursday. The sale will be conducted on prominent bourses such as the BSE and the National Stock Exchange, as per official notifications.

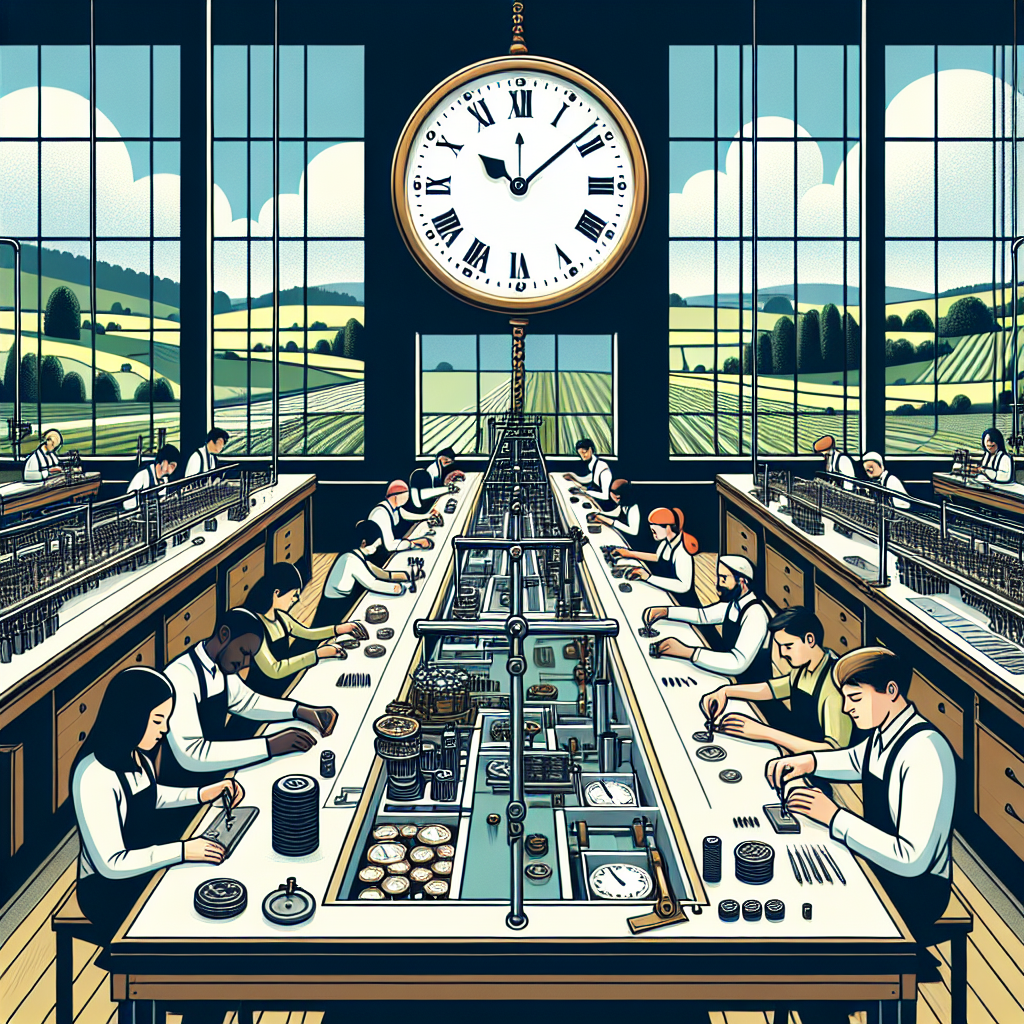

Currently, Timex Group holds a significant 74.93 percent stake in Timex Group India. Meanwhile, the company's diverse portfolio, featuring brands like Helix, TMX, and a range of luxury labels, remains integral to its business success in the Indian market.

(With inputs from agencies.)

- READ MORE ON:

- Timex Group

- India

- OFS

- stake sale

- floor price

- non-retail

- retail

- watch industry

- market dynamics

- growth