Financial Shifts: Highlighting Key Changes in Consultancy, Pharmaceuticals, and Infrastructure

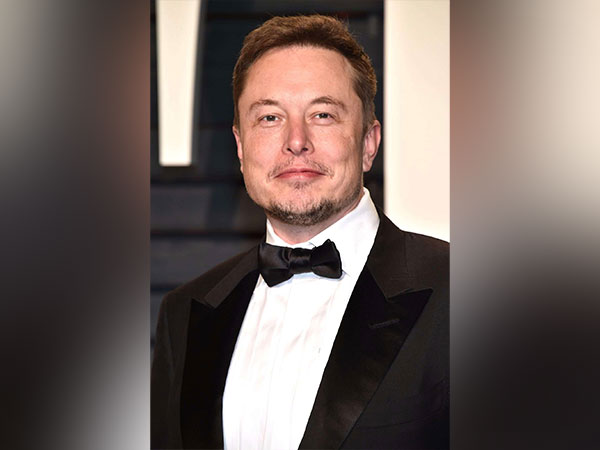

Ernst & Young reduces workforce due to declining consultancy demand, marking its weakest revenue growth since 2010. Sanofi invests $300 million in nuclear cancer treatment with OranoMed. EU considers including Elon Musk's business empire in revenue assessments. The UK proposes new 'buy now, pay later' regulations and explores alternative rail developments.

Ernst & Young, one of the Big Four accounting firms, has reduced its global workforce for the first time in 14 years. The firm cites a slowdown in demand for consultancy services as the reason behind the move, resulting in its weakest revenue growth since 2010.

Sanofi, the French pharmaceutical company, has secured a strategic foothold in the competitive radiopharmaceuticals sector by purchasing a $300 million stake in OranoMed. This subsidiary of the French nuclear fuel company Orano aims to develop a novel cancer treatment, reinforcing Sanofi's investment in cutting-edge medical technologies.

The European Commission is evaluating the inclusion of revenues from Elon Musk's business ventures to determine a potential fine for the social media platform X. Meanwhile, the UK government has initiated consultations to regulate 'buy now, pay later' lenders. Moreover, a new railway line between Birmingham and Manchester is being considered following the axing of HS2's northern leg.

(With inputs from agencies.)

- READ MORE ON:

- EY

- Sanofi

- Elon Musk

- UK railway

- ByNowPayLater

- FCA

- HS2

- European Commission

- OranoMed

- revenue