Rikhav Securities Set to Launch IPO, Eyes ₹88.82 Crore Funding

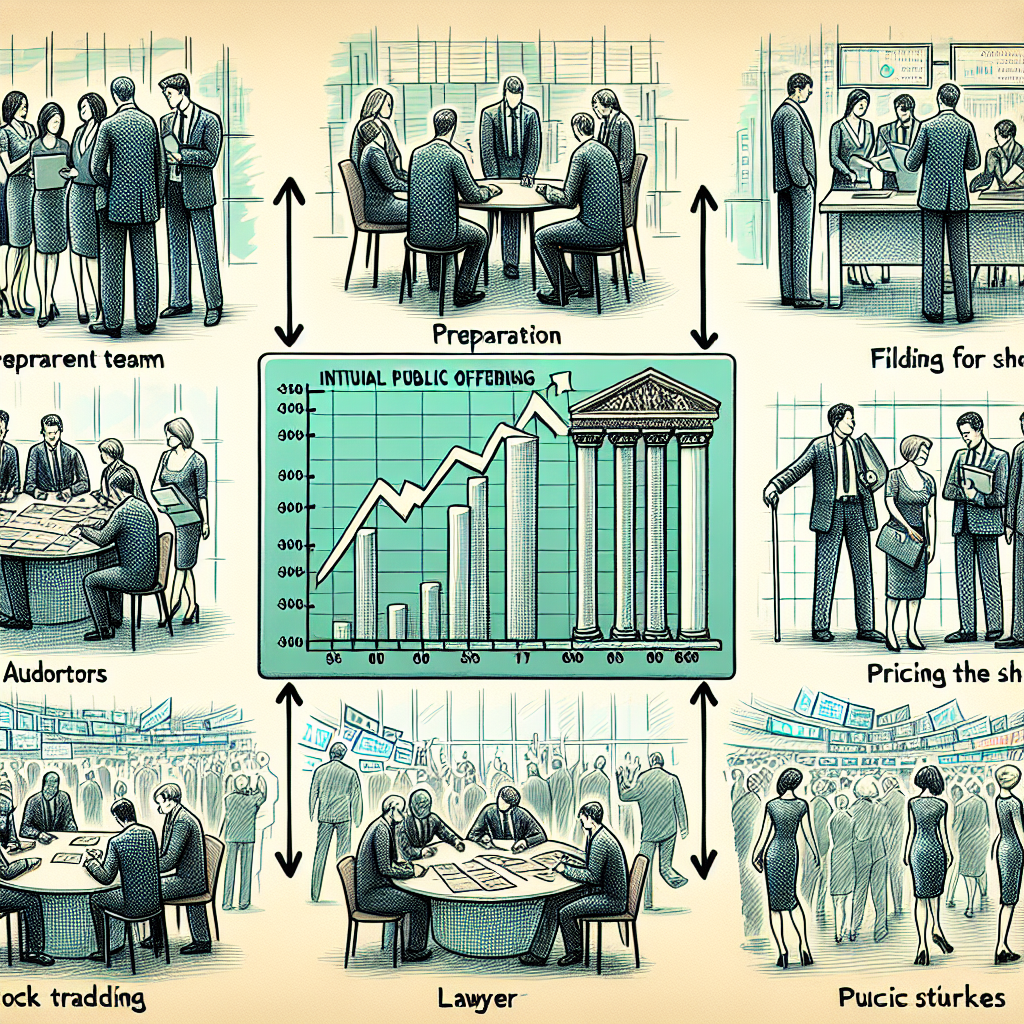

Rikhav Securities Limited, established in 1995, plans to launch an Initial Public Offering (IPO) from January 15 to January 17, 2025, aiming to raise ₹88.82 Crores. The IPO involves 1,03,28,000 equity shares at ₹82-₹86 per share, primarily to fund working capital, IT needs, and corporate purposes.

- Country:

- India

Rikhav Securities Limited, a prominent financial services firm in India, is preparing to go public with an Initial Public Offering (IPO) scheduled for January 15 to January 17, 2025. The company aims to raise ₹88.82 Crores through the issuance of 1,03,28,000 equity shares, priced between ₹82 and ₹86 each.

The firm plans to use the funds to boost its working capital, invest in IT infrastructure, and cover general corporate expenses. This move reflects a strategic push towards expanding its market presence and enhancing its service offerings in the financial sector.

Smart Horizon Capital Advisors Private Limited is managing the IPO, with Link Intime India Private Ltd acting as the registrar. Chairman Hitesh Himatlal Lakhani expressed enthusiasm about the growth opportunities this public offering presents for the company and its stakeholders.

(With inputs from agencies.)

ALSO READ

Japan's PM Takaichi Vows Strong Defense Amid China Tensions

Flash Mob Frenzy: SEBI Check's Theatrical Approach to Investor Safety

Ukraine's Defense Exports: A New Front in the War Effort

India's Observer Role in Trump's Board of Peace Initiative

India Observes at Trump's Controversial Board of Peace Inaugural