Govt to set up panel headed by finance secretary to improve NPS

It was initially designed for government employees exclusively, but its services were subsequently expanded to include all Indian nationals and NRIs, including self-employed persons.PFRDA promotes, develops and regulates organised pension funds namely National Pension System NPS to serve the old age income needs of people on a sustainable basis.

- Country:

- India

The government on Friday announced that a committee under the finance secretary will be set up to improve the New Pension System (NPS) with a view to take care of the concerns of employees while maintaining fiscal prudence.

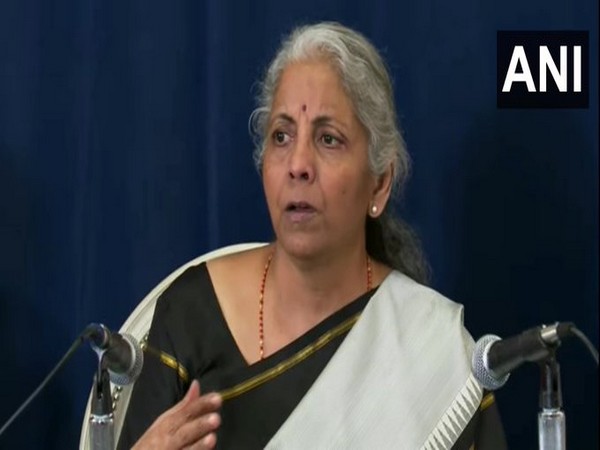

While moving the Finance Bill 2023 for consideration and passage in the Lok Sabha, finance minister Nirmala Sitharaman said that the new approach to the NPS will be designed for adoption by both central and state governments.

''I propose to set up a committee under the finance secretary to look into the issue of pensions and evolve an approach which addresses the needs of employees while maintaining fiscal prudence to protect common citizens,'' she said.

''The approach will be designed for adoption by both the central government and state governments,'' she said.

The decision comes in the backdrop of several non-BJP states deciding to revert to the DA-linked Old Pension Scheme (OPS) and also employee organisations in some other states raising demand for the same.

The state governments of Rajasthan, Chhattisgarh, Jharkhand, Punjab and Himachal Pradesh have informed the Centre about their decision to revert to the Old Pension Scheme and have requested a refund of corpus accumulated under the NPS.

Earlier this month, the central government informed Parliament that it is not considering any proposal to restore the OPS in respect of the central government employees recruited after January 1, 2004.

Under the OPS, retired government employees received 50 per cent of their last drawn salary as monthly pensions. The amount keeps increasing with hike in the DA rates. OPS is not fiscally sustainable as it is not contributory in nature and the burden on exchequer keeps on mounting.

The total assets under management under the National Pension System and Atal Pension Yojana stood at Rs 8.81 lakh crore as on March 4, 2023.

NPS has been implemented for all government employees except those in armed forces joining central government on or after 1st of January 2004. Most of the state/ Union Territory governments have also notified the NPS for their new employees.

According to the PFRDA (Pension Fund Regulatory and Development Authority), 26 state governments, with the exception of Tamil Nadu and West Bengal, have notified and implemented NPS for their employees.

NPS has been made available to every Indian citizen from May 1, 2009 on a voluntary basis.

Further, on June 1, 2015, the Atal Pension Yojana has been launched which has given the much required impetus to the social security schemes.

To regulate and develop the pension market, the government created PFRDA in 2003. It was initially designed for government employees exclusively, but its services were subsequently expanded to include all Indian nationals and NRIs, including self-employed persons.

PFRDA promotes, develops and regulates organised pension funds; namely National Pension System (NPS) to serve the old age income needs of people on a sustainable basis.

(This story has not been edited by Devdiscourse staff and is auto-generated from a syndicated feed.)

ALSO READ

Age Eligibility Debate Reignites for Jharkhand's 14th PSC Exam

Jharkhand Revises JPSC Age Criteria, Tackles Cyber and Narcotics Crimes

Jharkhand's Fiscal Boost: Supplementary Budget Passed for Development

Political Tug-of-War: Jharkhand's Municipal Election Delay Costs Rs 5100 Crores

Chhattisgarh Assembly: A Budget Session Amid High Stakes