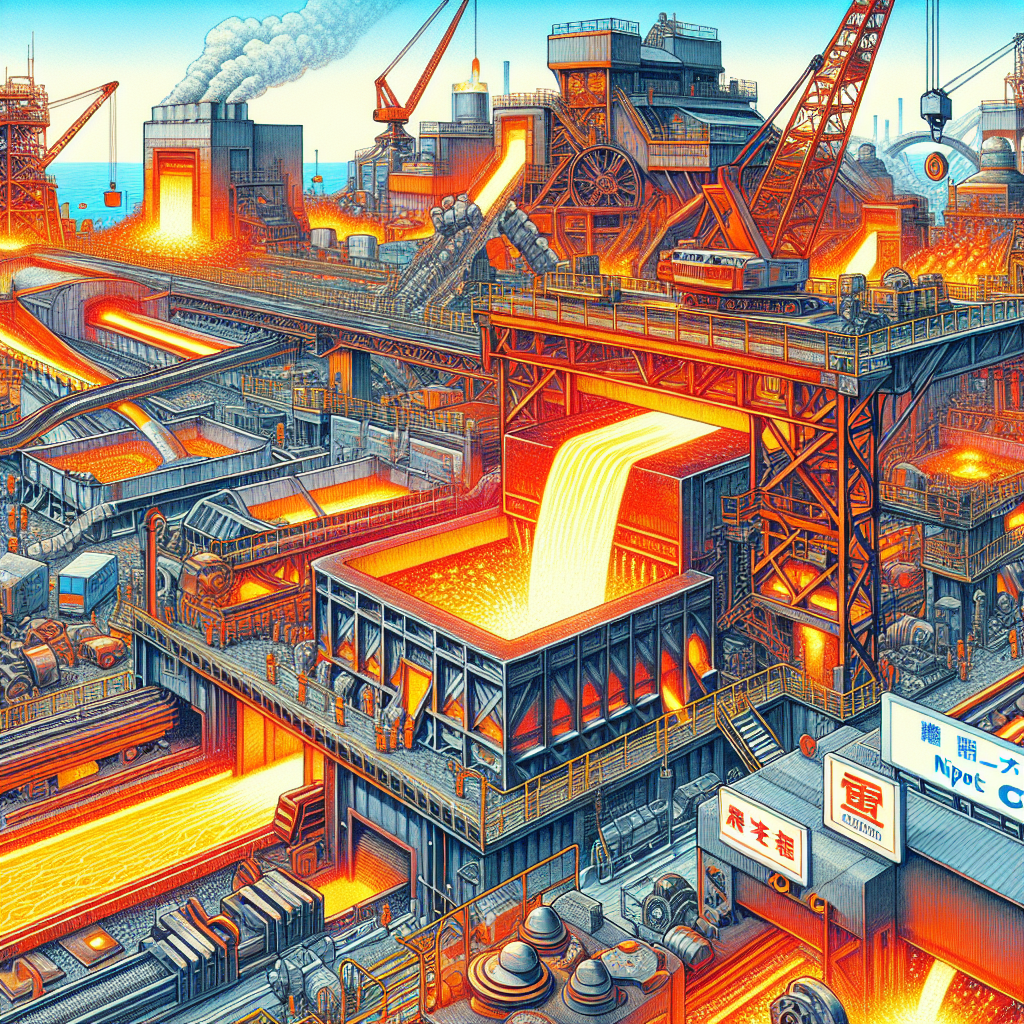

Nippon Steel's U.S. Steel Merger Faces Stiff Opposition

Nippon Steel's $14.9 billion bid to acquire U.S. Steel is facing significant resistance from the Committee on Foreign Investment in the United States (CFIUS) due to national security concerns. Despite numerous attempts to address these issues, the deal's approval remains uncertain, with President Biden potentially poised to intervene.

Nippon Steel's ambitious $14.9 billion bid to acquire U.S. Steel is under intense scrutiny by the Committee on Foreign Investment in the United States (CFIUS) over national security concerns. Despite multiple proposals and extensive discussions, the committee has yet to reach a consensus.

The critical decision now looms on the shoulders of President Joe Biden, who has historically opposed the merger. With the December deadline nearing, the fate of this major corporate acquisition could depend on negotiations and the outcome of the presidential election dynamics.

Key points of contention include whether Nippon Steel's investment pledges can sufficiently address the national security risks or if the deal poses a threat to U.S. interests. The unfolding situation emphasizes the complex interplay between business ambitions and national regulatory oversight.

(With inputs from agencies.)

ALSO READ

Surge in Foreign Investment Bolsters India's Economic Growth

Canada's Economic Slowdown: Inventory and Investment Impact

Foreign direct investments in India rise 18 pc to USD 47.87 billion during Apr-Dec of FY26: Govt data.

NRIs Shift Investments to Gift City IFSC Amid Global Financial Landscape Changes

Hong Kong Trader J Law Expands Investment Education Globally