Fed's Tightrope: Navigating Inflation Amid Trade Tensions

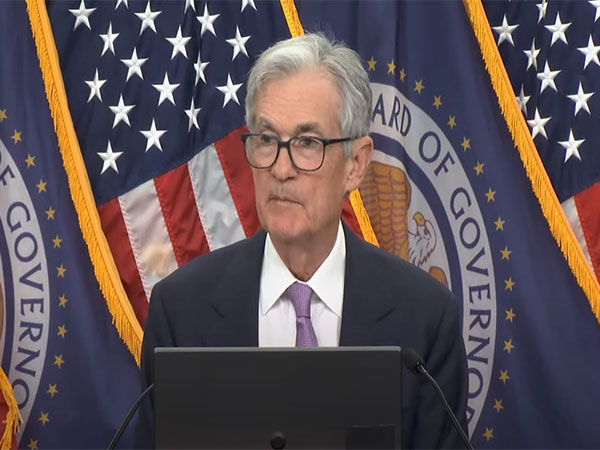

Federal Reserve Chair Jerome Powell emphasized to Congress that the Fed's focus remains on managing inflation, not endorsing or opposing the Trump administration's tariffs. Despite rising pressure, Powell underlined the importance of evaluating the impact of tariffs on the economy before adjusting interest rates.

U.S. Federal Reserve Chair Jerome Powell addressed Congress on Tuesday, clarifying that the central bank's role is not to take a stance on the Trump administration's tariffs but to manage the resulting inflationary pressures. Powell stressed, "We aren't commenting on tariffs," highlighting the Fed's sole focus on inflation control.

Responding to GOP lawmakers, Powell defended the Federal Reserve's proactive measures in anticipating inflation from tariffs, contrasting it with their past stance on Biden administration's spending policies, which initially were not expected to hike inflation. Amid calls for rate cuts from Trump, Powell acknowledged the consensus among economists predicting heightened inflation this year.

Powell outlined that the potential impact of tariffs might transiently elevate prices and affect economic activity, but it remains uncertain if these effects will persist. Investors recalibrated expectations following his testimony, now anticipating possible rate cuts in September, based on the central bank's economic projections and policy statements.

(With inputs from agencies.)