Italy can use new strategic fund to invest in listed firms

Once the bill is approved by parliament, the government will issue a decree defining how the fund will work and how to appoint its managing company, the draft said, suggesting multiple players could compete for the role. The fund will operate "on market terms" to avoid breaching European Union rules limiting state aid rules.

- Country:

- Italy

Italy's right-wing government can use a new strategic fund to buy stakes in listed companies outside of the financial sector, according to a draft bill seen by Reuters, signalling a more activist industrial policy.

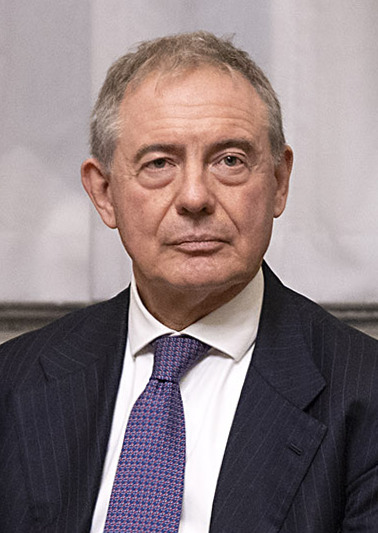

Dubbed the strategic fund for "Made in Italy", the scheme would support companies operating in key supply chains, while also aiming to boost procurement of "critical raw materials." Industry Minister Adolfo Urso will present the fund to U.S. investors on Thursday as part of a trip to Washington this week, his office said in a statement.

According to the draft, the fund can invest "directly or indirectly in the capital of listed firms which have their registered office in Italy and do not operate in the banking, financial or insurance sector." The bill is yet to be made official and could still be subject to change.

Rome's government deems the automotive industry and its supply chain strategic. However, the stipulation that investments target companies headquartered in Italy seems to exclude Stellantis, the owner of the Fiat brand and leading auto group in Italy, which has its legal base in the Netherlands.

The fund will have an initial endowment of 700 million euros ($770 million) in 2023 and an additional 300 million next year in state cash. Rome also intends to raise at least further 500 million euros from non-specified private investors.

Government sources have previously told Reuters that Prime Minister Giorgia Meloni is courting the sovereign wealth funds (SWFs) of Saudi Arabia, Qatar, the United Arab Emirates, Azerbaijan and Norway to give the fund more firepower. Once the bill is approved by parliament, the government will issue a decree defining how the fund will work and how to appoint its managing company, the draft said, suggesting multiple players could compete for the role.

The fund will operate "on market terms" to avoid breaching European Union rules limiting state aid rules. A previous draft reported by Reuters last month made reference to financial vehicles or investment funds promoted by the state lender Cassa Depositi e Prestiti (CDP). ($1 = 0.9084 euros)

(This story has not been edited by Devdiscourse staff and is auto-generated from a syndicated feed.)

ALSO READ

ICC Taps Doha for Critical Meetings Amid Qatar Cricket Boom

Cricket's Rapid Growth in Qatar: ICC Meetings Showcase Momentum

Carlos Alcaraz Continues Impressive Streak with Qatar Open Victory

Carlos Alcaraz Dominates at Qatar Open, Secures Title in Record Time

Alcaraz Dominates Qatar Open en Route to Yet Another Final