The Holiday Hangover: U.S. Spirit Sales Face Untimely Slump

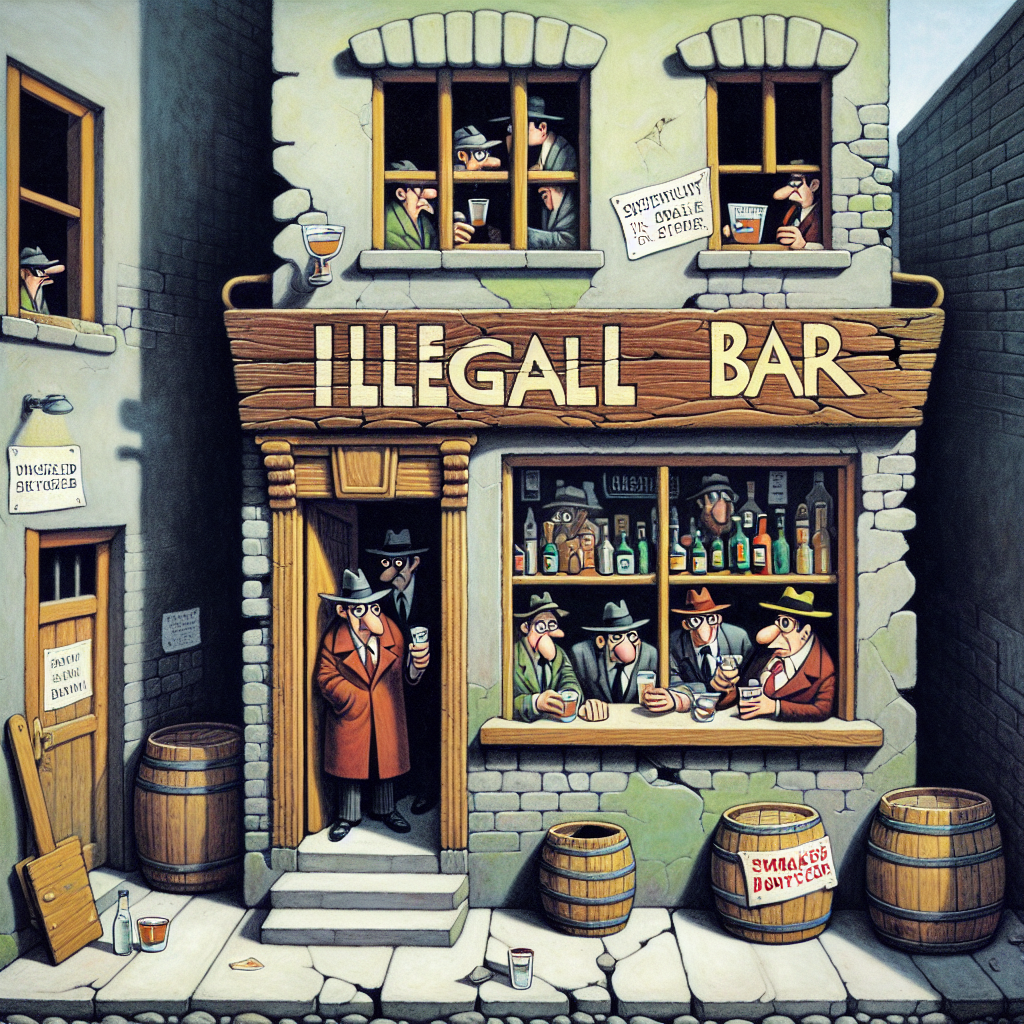

Meaghan Dorman's NYC bars remain lively, but sales are down as consumers shift to cheaper drinks. Economic strains like high inflation are impacting holiday spending habits. Major spirits producers face challenges as consumers buy less expensive brands, impacting annual sales critical for the industry.

Amid bustling scenes at popular venues, bars like Meaghan Dorman's in New York are grappling with a perplexing issue—visitors are buying fewer high-end cocktails despite the holiday hustle and bustle. Instead, patrons are opting for more economical choices such as lower-priced wines, reshaping spending patterns this season.

Economic challenges, including spiraling inflation, are causing middle-income U.S. consumers to rethink their festive beverage splurges, a reality acknowledged by three leading U.S. spirits distributors. This trend presents significant challenges for large producers like Diageo and Pernod Ricard, which rely heavily on holiday season sales.

As some drinkers opt for affordable venues or cut back on outside celebrations, wholesale sales are projected to decrease by 5.65%. This shift away from premium spirits is disrupting producers' strategies of enticing consumers with upscale options, especially amid a downturn after the pandemic-driven sales surge.

(With inputs from agencies.)

ALSO READ

Steak 'n Shake Drives Sales with Bitcoin Strategy; DeepSnitch AI Emerges as Next Crypto Boom

Olympic Fever: Late Surge in Winter Games Ticket Sales

Snapdeal Penalized for Non-Compliant Toy Sales

Ashiana Housing's Quarterly Profit Soars Despite Decline in Sales Bookings

Snapdeal Faces Rs 5 Lakh Penalty for Non-Compliant Toy Sales